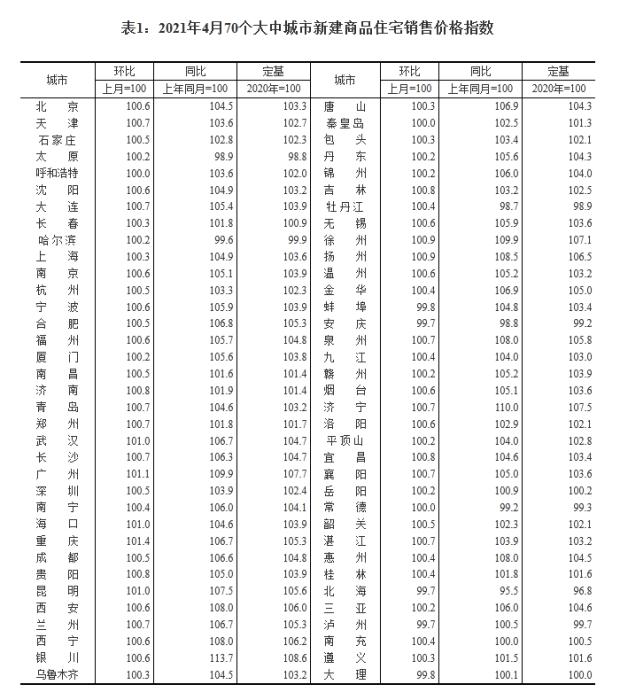

Beijing, May 17 (Zuo Yukun) "The sales price increase of new commercial housing in 70 large and medium-sized cities has generally expanded, and the increase of second-hand housing has risen and fallen." The National Bureau of Statistics announced on the 17th that the housing price data of 70 cities in April showed that.

The price of new houses in four first-tier cities rose by 0.6% month-on-month, with an increase of 0.2 percentage points over the previous month; The prices of new and second-hand houses in 31 second-tier cities rose by 0.6% and 0.5% respectively from the previous month, an increase of 0.1 percentage point over the previous month.

Is it normal that the regulation of the property market in many cities has been tightened and house prices are still rising? When will housing prices usher in an inflection point?

Chongqing and Guangzhou led the gains, and the heat of first-tier cities spread to the second line.

"It was originally expected that the data in April may fall rapidly, but from the market performance, most cities are still active. In particular, centralized land sales have led to hotter hot markets, and cities such as Chongqing and Guangzhou have become new leaders in the upward trend of market prices. " Zhang Dawei, chief analyst of Zhongyuan Real Estate, said.

In April, the prices of new houses in first-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen rose by 0.6%, 0.3%, 1.1% and 0.5% respectively. The prices of second-hand houses in Beijing, Shanghai and Guangzhou rose by 1.2%, 0.9% and 1.2% respectively, while Shenzhen was flat.

The regulation effect of Beijing, Shanghai and Shenzhen’s property market is remarkable. The price increase of new houses in Shanghai and Shenzhen has faded out of the top 30, and Guangzhou’s "leading the way" may surprise many people.

According to Li Yujia, chief researcher of Guangdong Housing Policy Research Center, the chaotic phenomenon of talent buying houses is the main driving force for the warming of Guangzhou property market and the direct reason for the regulation and overweight. During the "May 1" period, all transactions in the new housing market in Beishang Shenzhen plummeted, with Shanghai dropping 59%, Shenzhen dropping 43%, Beijing dropping 33%, and Guangzhou increasing 109% year-on-year.

From the Ministry of Housing and Urban-Rural Development’s interview with Guangzhou and Guangzhou’s interview with District 6 to the "Suiliutiao" new property market policy, the real estate financial policy has been tightened and the threshold for talents to buy houses has been raised. Talents to buy houses need to pay social security for one year, and the period of VAT exemption in District 9 has been raised to five years … … Guangzhou has recently taken frequent measures to regulate the property market.

Li Yujia predicted that "after Guangzhou’s regulatory policy was tightened at the end of April, the price limit policy was obviously strict. Combined with the transaction volume, the policy effect will begin to appear in May."

Sales price index of new commercial housing in 70 large and medium-sized cities in April 2021. Screenshot from National Bureau of Statistics official website

At the same time, the heat of the property market in first-tier cities has further spread to second-tier cities.

"The price of new houses in Chongqing increased the most from the previous month. Recently, there have indeed been many speculations about housing. Especially this double centralized underground supply, the overheated land transaction in Chongqing has attracted everyone’s attention. " Yan Yuejin, research director of the think tank center of Yiju Research Institute, said.

Chen Xiao, an analyst at Zhuge Housing Search Data Research Center, pointed out that Chongqing completed its first centralized land auction on April 28, and the enthusiasm of housing enterprises for bidding was high. Many plots were sold at a high premium, and even the floor price record in Chongqing was refreshed. The heat can be seen. To a certain extent, it boosted the heat of the Chongqing property market.

"Chongqing’s new home prices rose for the first time, leading hot cities, which means that with the gradual upgrading of regulation, the property market heat has been transmitted from first-tier cities to general second-tier cities." Li Yujia said that the cities with the highest growth rate are basically weak second-tier cities. The property market in first-and second-tier hot cities was controlled, but the property market in non-hot second-tier cities began to rise.

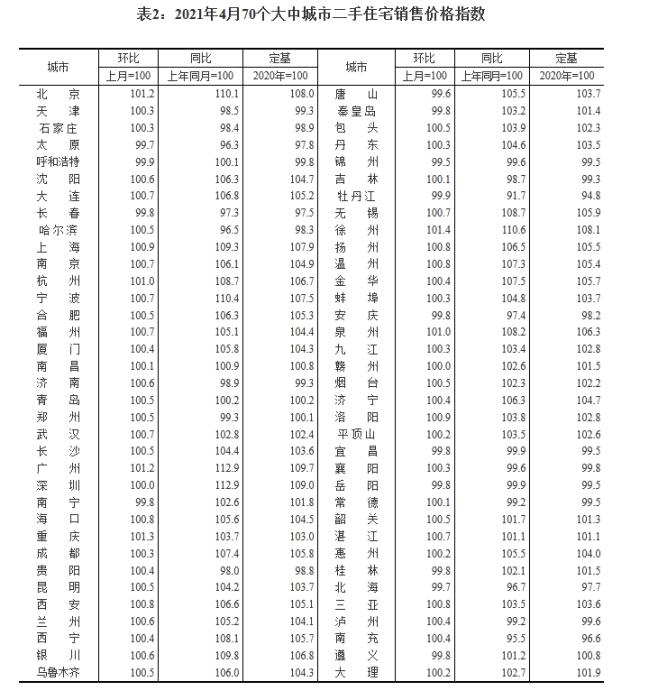

The turning point of the second-hand housing market appears, but it is still the focus of regulation.

"However, in the case of a large increase in the price of new houses, the price increase of second-hand houses in first-tier cities has dropped significantly. The most important thing is that many regulatory policies introduced by first-tier cities are related to regulating the second-hand housing market, and the policy effects are gradually emerging." Lu Qilin, research director of 58 Anjuke Real Estate Research Institute, said.

Lu Qilin pointed out that most of the second-tier cities still focus on the new housing market, while the second-hand housing transactions in first-tier cities account for more than 70%. The decline in the price increase of the second-hand housing market will be gradually transmitted to the new housing market in the second half of the year, thus guiding the price stability of the entire real estate market.

According to the data of the National Bureau of Statistics, the sales prices of second-hand houses in four first-tier cities rose by 0.8% month-on-month, and the growth rate dropped by 0.2 percentage points from last month. After the introduction of the second-hand housing guidance price in Shenzhen, the house price increased by zero for the first time, which was obviously controlled.

Sales price index of second-hand houses in 70 large and medium-sized cities in April 2021. Screenshot from National Bureau of Statistics official website

"The turning point of the second-hand housing market appeared in April." Xu Xiaole, chief market analyst of RealData, believes that the price increase of first-tier cities and hot-spot second-tier cities such as Hefei and Chengdu has narrowed compared with last month, mainly because the regulation effect of first-and second-tier hot-spot cities continues to appear, the superimposed market falls seasonally, and the market expectation weakens, which drives the second-hand housing market to adjust back after peaking in March.

Li Yujia also believes that at present, the credit lines of hot cities have been tightened in an all-round way, second-hand housing loans have been tightened, and interest rates have also climbed. According to this logic, it is expected that the second-hand housing market will cool down in the second half of the year.

"From the performance of the follow-up market, the supervision of second-hand housing should also be the key." Yan Yuejin said that at present, among 70 cities, 28 cities have increased by more than 5% year-on-year, and the number exceeds that in March. This shows that local governments need to be alert to the overheating of second-hand houses and strictly control the market price order, especially in school districts.

On April 30th, the Political Bureau of the Communist Party of China (CPC) Central Committee held a meeting, which rarely mentioned "school district housing" and proposed "to prevent the speculation of housing prices in the name of school district housing".

Under strict control, why is the price increase still expanding?

Interview with the Ministry of Housing and Urban-Rural Development, rectification of intermediary, business loan and land supply reform … … Compared with the real estate regulation in the first quarter, the real estate regulation was upgraded in April. According to the agency’s rough statistics, in April, the monthly real estate regulation and control set a new record for the year, reaching 51 times, and the cumulative regulation and control times reached 186 times during the year.

But under such control, why is the price increase still expanding?

"The expansion of the increase shows that the market is under pressure. In other words, all kinds of funds are still accelerating into the property market, and this risk needs attention." Yan Yuejin told Zhongxin.com that "policy tightening only excludes some people from entering the market. However, people who need to buy houses may still accelerate their entry. If the contradiction between supply and demand is not resolved, it will be reflected in housing prices. "

"Whether the subsequent housing prices will turn around depends on credit control and local policies. According to the current tone and control actions, there may be a turning point and stabilization in house prices. " Yan Yuejin said that this requires further control of cities with rising signs on the basis of existing regulation.

Specifically, on the one hand, it is necessary to continue to suppress and strictly control the property market, crack down on the speculation of existing housing projects, and prevent the chaos of screening customers and bundling sales in some urban housing enterprises; On the other hand, it is necessary to continue to increase land supply, especially to urge housing enterprises to actively supply projects.

Where you live, what is the trend of house prices? How much is it per square meter?