State and municipal people’s governments, provincial departments and provincial enterprises:

The Interim Measures for the Performance Assessment of the Persons in Charge of Provincial Enterprises in Yunnan Province have been approved by the provincial people’s government and are hereby printed and distributed to you, please implement them carefully.

General Office of Yunnan Provincial People’s Government

July 31, 2020

(This piece is publicly released)

Interim Measures for the Performance Assessment of Responsible Persons of Provincial Enterprises in Yunnan Province

Chapter I General Principles

sequenceitem In order to fully implement the spirit of the 19th National Congress of the Communist Party of China and the series of decision-making arrangements made by the CPC Central Committee, the State Council, the provincial party committee and the provincial government on deepening the reform of state-owned enterprises and improving the management system of state-owned assets, earnestly fulfill the responsibilities of investors in state-owned assets of enterprises, safeguard the rights and interests of owners, fulfill the responsibility of maintaining and increasing the value of state-owned assets, establish and improve an effective incentive and restraint mechanism, guide the high-quality development of provincial enterprises, and continue to become stronger, better and bigger. According to "People’s Republic of China (PRC) Company Law", "People’s Republic of China (PRC) State-owned Assets Law", "Provisional Regulations on the Supervision and Administration of State-owned Assets of Enterprises" and other laws and regulations and the relevant provisions of comprehensively deepening the reform of state-owned assets and state-owned enterprises, combined with the actual situation in our province, these measures are formulated.

the second The measures referred to in provincial enterprises, refers to according to the authorization of the provincial people’s government, by the State-owned Assets Supervision and Administration Commission of the provincial people’s government (hereinafter referred to as the provincial SASAC) or other provincial departments (hereinafter referred to as the competent department) to perform the investor’s duties of state-owned or wholly-owned enterprises, state-owned holding enterprises.

Article The person in charge of the provincial enterprises assessed in the present Measures refers to the members of the board of directors (excluding external directors and employee directors) managed by the party committee of the provincial party committee or the provincial SASAC and the party group (party committee) of the provincial department.

The board of directors of provincial enterprises shall, in accordance with the corporate governance structure of the company, establish and improve the performance appraisal system for senior managers based on the post target responsibility system.

Article 4 The person in charge of provincial enterprises shall follow the following principles in the performance evaluation:

(a) adhere to the quality first, benefit first. Firmly establish a new development concept, take the supply-side structural reform as the main line, vigorously promote innovation-driven development, accelerate the quality change, efficiency change and power change of economic development, continuously enhance the competitiveness, innovation, control, influence and risk resistance of the state-owned economy, and constantly strengthen and improve the state-owned capital.

(2) Adhere to the direction of marketization. Follow the laws of socialist market economy and enterprise development, improve the market-oriented operation mechanism, give full play to the decisive role of the market in resource allocation, strengthen positive incentives and industry benchmarking, stimulate the vitality of enterprises, and accelerate the formation of domestic first-class enterprises with market competitiveness.

(3) Adhere to the law and regulations. Accurately grasp the regulatory boundaries of investors, perform the responsibilities of investors in accordance with laws and regulations, adhere to strengthening the supervision of state-owned assets mainly by managing capital, and effectively implement the responsibility of maintaining and increasing the value of state-owned assets.

(4) Adhere to the organic unity of short-term goals and long-term development. Give full play to the leading role of enterprise strategy, combine annual assessment with term assessment, unify result assessment with process assessment, and actively build an assessment system based on current and long-term perspective.

(five) adhere to the classification assessment. Coordinate the economic, political and social responsibilities shouldered by provincial enterprises. According to the strategic positioning and development goals of state-owned capital, enterprises with different functions and categories should be highlighted with different assessment focuses, assessment indicators and weights should be set reasonably, and classified and differentiated assessments should be implemented.

(six) adhere to the close combination of incentives and constraints. Adhere to the unity of rights, responsibilities and interests, and establish a differentiated incentive and restraint mechanism that matches the way of selecting the person in charge of the enterprise, adapts to the functional nature of the enterprise, and is linked to business performance.

Article 5 The business performance of the person in charge of a provincial enterprise shall be assessed according to the year and term of office, and the assessment system linked with rewards and punishments shall be implemented. The annual and term business performance assessment shall be conducted by the way that the provincial SASAC, the competent department is mainly responsible for the person or its authorized representative and the chairman of the provincial enterprise or its authorized representative sign a letter of responsibility for business performance.

Chapter II Assessment Orientation

Article 6 Highlight efficiency, guide enterprises to accelerate the transformation of development mode, optimize resource allocation, continuously improve economic benefits, capital return level, labor output efficiency and value creation ability, and realize development with higher quality, better efficiency and better structure.

Article 7 Highlight reform and development, guide enterprises to improve the market-oriented operating mechanism, focus on the main business to strengthen the industry, accelerate structural adjustment, transformation and upgrading, focus on filling the shortcomings of development, actively cultivate new kinetic energy, and continuously improve the ability of coordinated and sustainable development.

Article 8 Highlight the drive of innovation, guide enterprises to adhere to independent innovation, increase investment in research and development, accelerate the transformation of scientific and technological achievements, and continuously enhance their core competitiveness.

Article 9 Highlight risk prevention and control, guide enterprises to guard against operational risks, reasonably control the level of assets and liabilities, and promote the sustained and healthy development of enterprises.

Article 10 Highlight social contributions, ensure the province’s economic and social stability, play an important role in developing forward-looking industries, and encourage enterprises to make more contributions in promoting and stabilizing employment, paying taxes and state-owned capital gains, tackling poverty and protecting the ecological environment.

Article 11 Highlight accountability, guide enterprises to make scientific decisions, operate in compliance with laws and regulations, guard against operational risks, prevent the loss of state-owned assets, and safeguard the security of state-owned capital.

Chapter III Classified Assessment

Article 12 According to the function definition and classification of state-owned enterprises, provincial enterprises are divided into commercial and public welfare categories. Among them, commercial enterprises are subdivided into commercial category I and commercial category II; According to the strategic position and development goal of state-owned capital, enterprises with different functions and categories should be highlighted with different assessment focuses, and the indicators and weights of business performance assessment should be set reasonably, and classified assessment should be implemented.

Article 13 For commercial first-class enterprises, the economic benefits, capital return level and market competitiveness of enterprises should be mainly assessed with the guidance of enhancing the vitality of state-owned economy, amplifying the functions of state-owned capital and realizing the preservation and appreciation of state-owned capital.

Article 14 For commercial second-class enterprises, while assessing the economic benefits, capital return level and market competitiveness of enterprises, we should strengthen the assessment and evaluation of the completion of specific functional tasks undertaken, and appropriately reduce the assessment weight of economic benefits indicators.

Article 15 For public welfare enterprises, adhere to the combination of economic benefits and social benefits, put social benefits in the first place, and focus on assessing the development level of core business, product and service quality, cost control, operational efficiency and support ability. Moderately reduce the assessment weight of economic benefit indicators.

Chapter IV Annual Operating Performance Assessment Indicators

Article 16 The annual business performance evaluation index consists of three parts: quality and benefit index, reform and development index and benchmarking evaluation.

(1) Quality and benefit indicators include total profit and economic added value. For commercial enterprises whose profit rate of operating income in the previous year was lower than the average level of the same industry in the same period of state-owned enterprises nationwide, increasing profit rate of operating income was taken as the third indicator.

The above indicators are calculated according to the consolidated statements of enterprise groups. Due to non-market factors such as administrative allocation and policy adjustment, the assets, profits and losses of the enterprise have undergone major changes, and they shall be adjusted according to the facts; If the expenditures that can be regarded as profits due to innovative investment in scientific and technological research and development, dealing with historical issues, staff training and recognition by the competent authorities affect the current benefits, they can be regarded as the total profits of the current period.

(2) The reform and development indicators refer to the key work and key task indicators of the enterprise in terms of internal industrial development, capital optimization and innovation breakthrough.

(3) Benchmarking evaluation consists of two parts: industry benchmarking performance evaluation and short-board indicator improvement evaluation.

Article 17 Differentiated assessment shall be carried out for different types of enterprises, different weights shall be given to the assessment contents of each part, and the comprehensive score of annual business performance assessment shall be calculated by weighted summary (see Annexes 1 and 2 for details).

Enterprises with heavy major special tasks and major reform tasks and in a period of major structural adjustment can appropriately reduce the weight of quality and efficiency indicators and increase the indicators of relevant special or reform tasks.

The fifth chapter term operating performance evaluation index

Article 18 The evaluation index of business performance during the term of office consists of three parts: quality and benefit index, evaluation of reform and development ability and application of annual evaluation results during the term of office.

(1) Quality and benefit indicators. The quality and benefit indicators of commercial enterprises include return on net assets, asset-liability ratio (deposit growth rate for financial enterprises) and the rate of maintaining and increasing the value of state-owned capital.

The quality and benefit indicators of public welfare enterprises mainly assess the development level and quality of the core indicators of the main business of the enterprise, and the specific assessment indicators are selected and determined in combination with the nature of the main business of the enterprise and are clearly defined in the operating performance responsibility book. In principle, the assessment target value is determined by the fair and quantifiable average value released by the industry. If there is no industry average value, it can be clearly defined in combination with the actual situation of the enterprise, and the assessment index should not exceed 3 in principle.

(2) Evaluation of reform and development capacity. The evaluation of reform and development ability refers to the evaluation of the work measures and implementation effects of supply-side structural reform, capital structure optimization, innovation-driven development, corporate governance, internal control and risk prevention during the term of office of the board of directors in combination with the implementation of the enterprise development strategy.

(three) the use of the annual assessment results during the term of office. Based on the arithmetic average of the business performance assessment results of three years during the term of office, the score is calculated according to the weight of 10%.

Article 19 Differentiated assessment shall be carried out for different types of enterprises, different weights shall be given to the assessment contents of each part, and the annual assessment results shall be calculated by weighted summary (see Annexes 3 and 4 for details).

Enterprises with heavy major special tasks and major reform tasks and in a period of major structural adjustment can appropriately reduce the weight of quality and efficiency indicators and increase the indicators of relevant special or reform tasks.

Chapter VI Implementation of Business Performance Assessment

Article 20 The annual business performance assessment takes the Gregorian calendar year as the assessment period; The term of office performance assessment is 3 years.

Article 21 The contents of the responsibility book for operating performance shall be determined by the provincial SASAC or the competent department and provincial enterprises in accordance with the procedures (see Annex 5 for details).

Article 22 Establish a dynamic tracking system for the implementation of business performance objectives. The board of directors of the enterprise shall form a semi-annual operating performance analysis report in July each year against the assessment contents and report it to the provincial SASAC or the competent department, which shall give an early warning to the enterprises whose assessment targets are not satisfactory.

Article 23 Establish a reporting system for major events. The board of directors of a provincial enterprise shall report to the provincial SASAC or the competent department in a timely manner if it has a significant impact on its business performance due to the occurrence of major safety accidents and cyber security incidents, major environmental emergencies, major quality accidents, major asset losses, major legal disputes, major investment and financing, and asset restructuring.

Article 24 The business performance assessment shall be conducted in accordance with the following procedures:

(a) submit the assessment summary materials. At the end of the assessment period, the board of directors of the enterprise shall, according to the audited financial final accounts data, form a summary and analysis report on operating performance according to the contents of the responsibility book for operating performance and the assessment objectives, and submit it to the provincial SASAC or the competent department after deliberation and approval by the board of directors.

(two) the performance review to form an opinion. Provincial State-owned Assets Supervision and Administration Commission or the competent department shall, on the basis of the audited financial final accounts report and special report of the enterprise, combine the summary and analysis report of the enterprise’s operating performance and the dynamic monitoring during the assessment period, assess the completion of the operating performance of the person in charge of the provincial enterprise, and form an assessment and reward and punishment opinion.

(three) the assessment opinions for feedback. Provincial State-owned Assets Supervision and Administration Commission (SASAC) or the competent department will feedback the business performance evaluation opinions to the board of directors of provincial enterprises, and if there is any objection to the evaluation opinions, it can be reflected to the provincial SASAC or the competent department.

(four) determine the assessment results issued. Provincial State-owned Assets Supervision and Administration Commission (SASAC) or the competent department issued the business performance assessment results to the board of directors of the enterprise.

Chapter VII Application of Assessment Results

Article 25 According to the scores of the business performance assessment of the heads of provincial enterprises, the final results of the annual and term business performance assessment are divided into four levels: A, B, C and D..

Article 26 Provincial State-owned Assets Supervision and Administration Commission or the competent department shall calculate and determine the performance salary standard of the person in charge of the enterprise according to the annual and term business performance evaluation results, and implement rewards and punishments, specifically in accordance with the relevant provisions on the salary management of the person in charge of the provincial enterprise.

The results of business performance assessment are an important part of the comprehensive assessment of the leading bodies and members of provincial enterprises.

Article 27 If the person in charge of the enterprise has a grade D annual business performance assessment result for two consecutive years or a grade D term business performance assessment result, and there is no major objective reason, the person in charge of the enterprise who is directly responsible, the provincial SASAC or the competent department shall propose adjustment suggestions or make adjustments.

Article 28 Provincial enterprises have made remarkable achievements in innovation work, completed outstanding achievements in major special tasks of the provincial party committee and the provincial government and the provincial SASAC or the competent department, actively participated in society and made significant contributions, and awarded extra points for the annual or term business performance assessment of the person in charge of the enterprise as appropriate.

In case of major and above production safety accidents, major and above ecological and environmental incidents, violations of laws and regulations, financial fraud, and comprehensive management and stability (safe construction) accidents, which seriously affect the production and life order of enterprises or cause negative social impact, points shall be deducted for the annual or term business performance assessment of the person in charge of enterprises, and responsibility shall be investigated according to procedures and specific circumstances.

Chapter VIII Supplementary Provisions

Article 29 For provincial enterprises without a board of directors, the performance evaluation of their leading members shall be implemented with reference to these measures.

The board of directors of provincial enterprises shall assess the operating performance of senior managers, and the results shall be submitted to the provincial SASAC or the competent department for the record.

Party committees of provincial enterprises assess the work of deputy party secretaries and trade union chairmen, and report the results to the provincial SASAC or the competent authorities for the record.

If there are other provisions on the assessment of the secretary of the Disciplinary Committee of provincial enterprises (the head of the Discipline Inspection and Supervision Team), such provisions shall prevail.

Article 30 Newly-established enterprises and enterprises with abnormal operations shall, according to the actual situation of enterprises, implement the "one enterprise, one policy" assessment, and the specific assessment items shall be specified in the responsibility book.

The newly established enterprise is an enterprise established less than half a year in the assessment year; An abnormal business enterprise is an enterprise in an abnormal business state during the period of judicial reorganization or special rectification.

Article 31 These Measures shall apply to provincial enterprises authorized by the provincial people’s government to perform the responsibilities of investors by the provincial SASAC and other provincial departments.

Provincial State-owned Assets Supervision and Administration Commission entrusts provincial enterprises supervised by relevant provincial departments, and in accordance with the entrustment supervision agreement, the entrusted department may formulate measures for assessing the operating performance of the person in charge of the entrusted supervision enterprise with reference to these measures, and shall be responsible for organizing the implementation.

The provincial people’s government authorizes other provincial departments, institutions and social organizations to run enterprises, and the department (in charge) that performs the responsibilities of the investor shall formulate the methods for assessing the operating performance of the person in charge of the supervised enterprises with reference to these measures, and shall be responsible for organizing the implementation after reporting to the Provincial Department of Finance for the record.

Article 32 Provincial State-owned Assets Supervision and Administration Commission (SASAC) supervises the performance evaluation of the person in charge of the provincial financial enterprises with reference to the implementation of the first-class commercial enterprises. If there are other provisions in laws, regulations or relevant documents and policies of the provincial party committee and government, those provisions shall prevail.

Article 33 These Measures shall be interpreted by the provincial SASAC and the Provincial Department of Finance.

Article 34 These Measures shall come into force as of September 1, 2020.

Attachment: 1. Detailed Rules for Scoring Annual Operating Performance Assessment

2 annual reform and development indicators evaluation rules

3. Detailed rules for the evaluation and scoring of operating performance during the term of office

4. Evaluation rules for the reform and development ability during the term of office

5. Contents and signing procedures of responsibility book for operating performance

6. Description of relevant indicators for business performance assessment

7 operating performance assessment score plus (deduction) sub rules

Annex 1

Scoring rules for annual business performance assessment

I. Comprehensive Scoring Formula for Annual Business Performance Assessment

According to the enterprise category classification score:

Commercial enterprises: comprehensive score of annual business performance assessment = quality and benefit index score ×50%+ reform and development index score ×30%+ benchmark evaluation score ×20%+∑ assessment plus points-∑ assessment minus points.

Among them, the comprehensive score of the annual business performance assessment of the second-class commercial enterprises undertaking specific functions and tasks = quality and efficiency index score ×40%+ reform and development index score ×30%+ benchmark evaluation score ×30%+∑ assessment plus points-∑ assessment deduction points.

Public welfare enterprises: comprehensive score of annual business performance assessment = quality and benefit index score ×20%+ reform and development index score ×30%+ benchmark evaluation score ×50%+∑ assessment plus points-∑ assessment minus points.

Two, the annual operating performance evaluation index score

(a) the quality and efficiency index score (calculated by percentage system)

Quality and benefit index score = total profit score (60%)+ economic added value score (40%)

Among them, if the profit rate of commercial enterprises’ operating income in the previous year was lower than the industry average, the quality and benefit index score = total profit score (60%)+ economic added value score (30%)+ operating income profit rate score (10%).

1. The total profit takes the annual target number determined by the board of directors of the enterprise as the assessment target, and the assessment target should be connected with the financial budget, and scored according to the difference between the target value and the benchmark value.

Based on the weighted average of the enterprise’s completed value in the first three years (calculated according to the weight of the completed value in the previous year accounting for 60%, the second year accounting for 30%, and the third year accounting for 10%) and the actual completed value in the previous year, which is the greater value is the benchmark value.

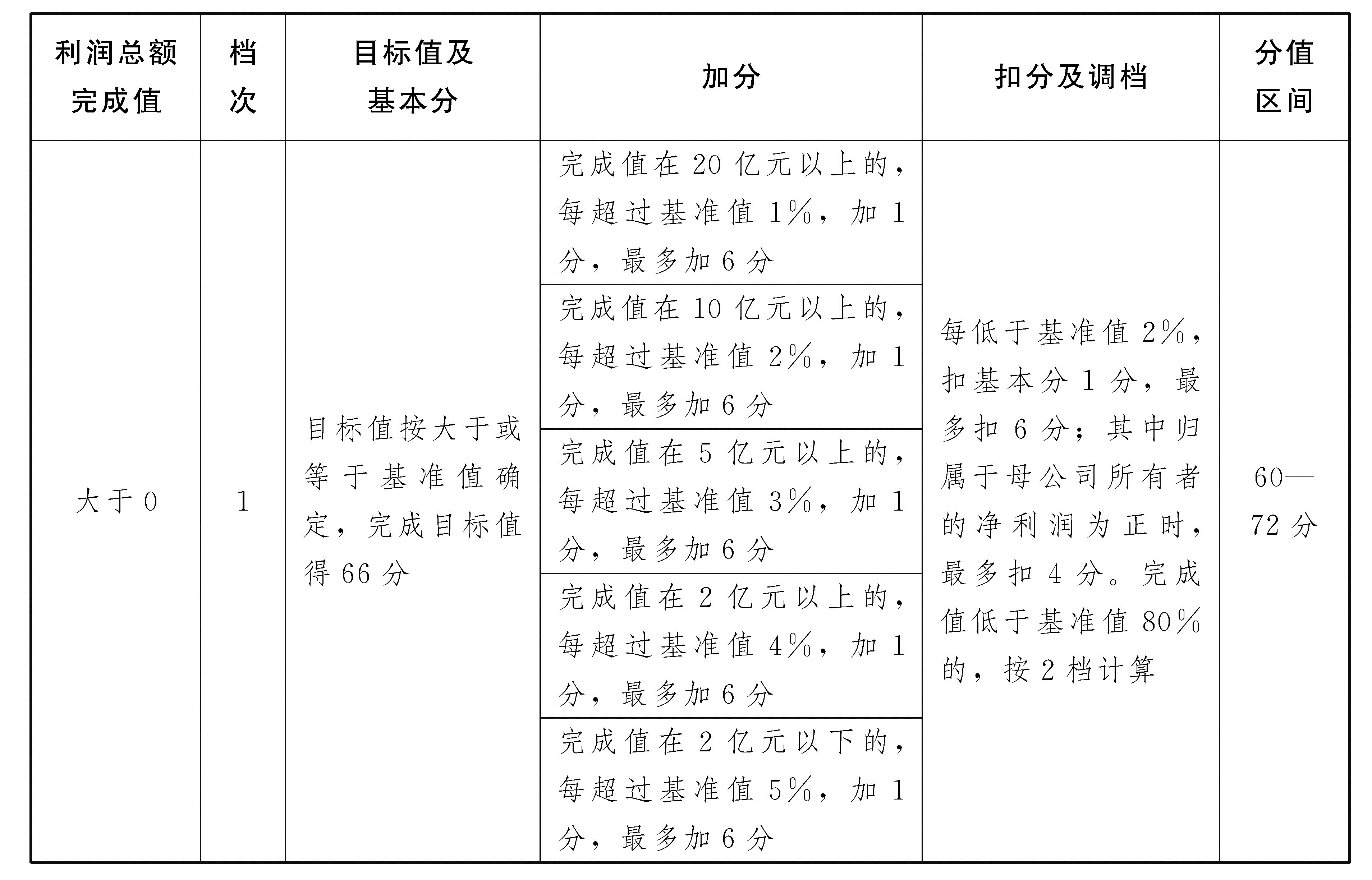

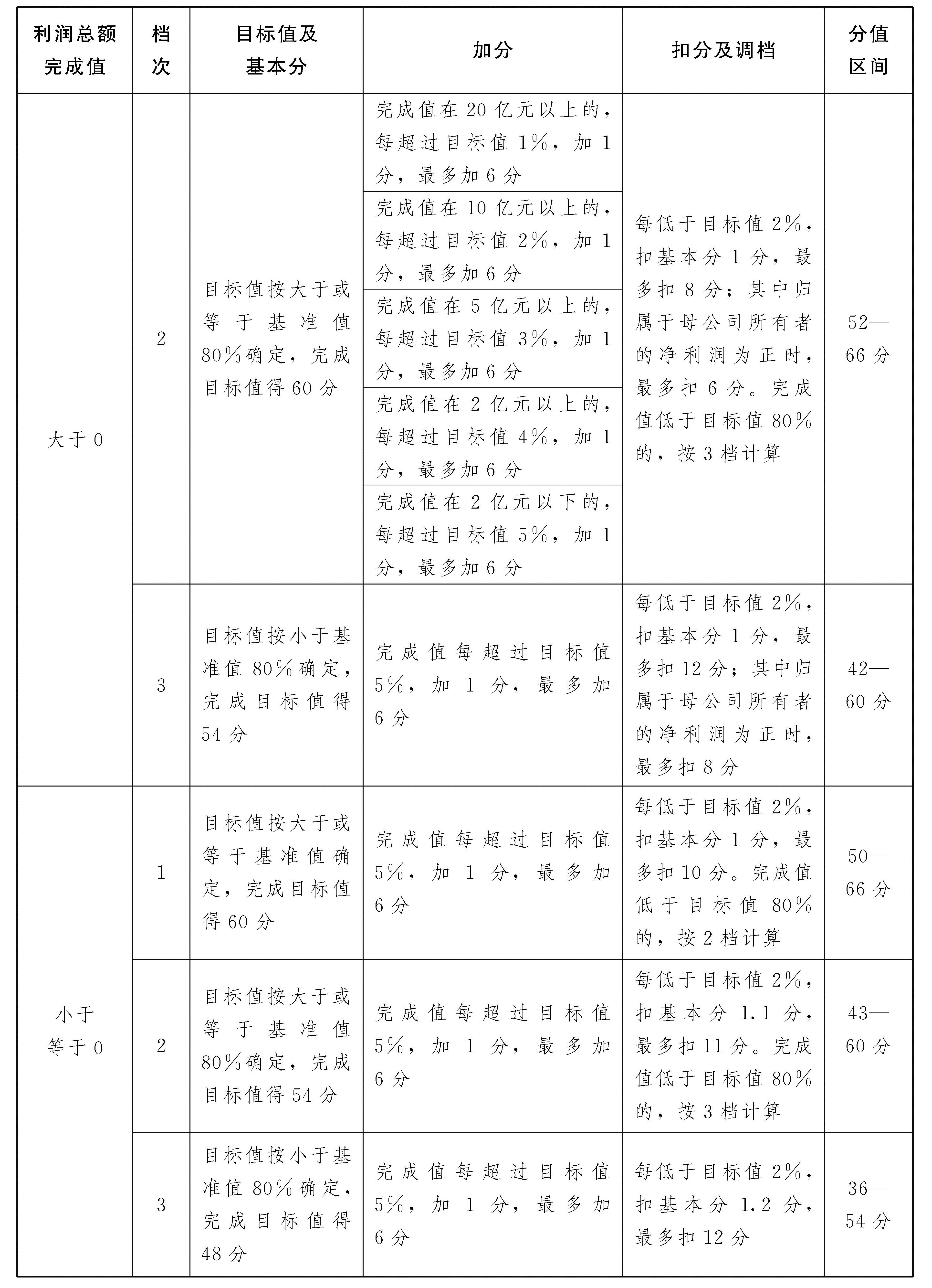

The completion value is divided into three grades. When the total profit is positive, the score range of this indicator is 42-72 points. When the total profit is negative, the score range of this indicator is 36-66 points. The score is calculated as follows:

2. The economic added value is the weighted average of the completed value in the first three years of the enterprise (calculated according to the weight of the completed value in the first year accounting for 60%, the second year accounting for 30% and the third year accounting for 10%) and the actual completed number in the previous year, that is, the scoring benchmark value, and the score is calculated according to the completion ratio.

When the completion value is positive, the scoring formula is: score = completion value/target value × weight (where when the target value is not positive and the completion value is positive, the weight ×1.2 score is obtained directly); The index is overfulfilled, with a maximum weight of ×0.2; Unfinished, the maximum deduction weight ×0.4 score; When the completion value is positive, the score interval of this indicator is weight ×0.6— weight ×1.2.

When the completion value is not positive, the weight of the completion target value is ×0.9 (where when the target value is positive and the completion value is not positive, the weight is ×0.5 directly); If the index is overfulfilled, the maximum weight shall be 0.1 (exceeding the target value by 20% or more); Incomplete, points will be deducted according to the proportion of unfinished, and the maximum weight will be deducted by 0.4 (50% or more below the target value); If the completion value is not positive, the score interval of this indicator is weight ×0.5— weight score.

3. The profit rate of operating income above the annual completion value is the benchmark value, reaching the industry average level and getting 10 points. If there is improvement over the previous year, the score will be calculated according to the degree of improvement, and if there is no improvement, the score will not be scored.

For commercial enterprises whose profit rate index of operating income in the previous year was greater than the industry average, the profit rate index of operating income was not included in the assessment.

(two) the reform and development index score (calculated in percentage system)

Reform and development index score = reform and development index 1 score+reform and development index 2 score+reform and development index 3 score+reform and development index 4 score+reform and development index 5 score+reform and development index 6 score.

The reform and development indicators are assessed and scored according to the indicators signed by the annual performance responsibility book and the completion situation. The specific indicators and weights are clearly defined in the responsibility book.

(three) the benchmark evaluation score (calculated in percentage system)

Benchmarking evaluation score = industry benchmarking performance evaluation score (80%)+ short board indicator improvement evaluation score (20%)

1. The industry benchmarking performance evaluation is scored by comparing the six main financial performance indicators (return on net assets, return on total assets, turnover rate of total assets, turnover rate of accounts receivable, asset-liability ratio, sales [business] growth rate) reflecting the profitability, asset quality, debt risk and business growth of enterprises with the standard values of performance evaluation of enterprises in the same industry published by the State Council SASAC in the same period. The score of quantitative evaluation of financial performance is calculated by percentage system. For the specific content of the target, refer to the Interim Measures for the Administration of Comprehensive Performance Evaluation of Central Enterprises (Order No.14 of the State-owned Assets Supervision and Administration Commission of the State Council) and its implementation rules to reasonably determine the weight and indicate it in the letter of responsibility.

When the index reaches the excellent level of the industry, get 100% score; If the index reaches a good level in the industry, 80% will be scored; If the index reaches the industry average, score 60%; If the index reaches the lower level of the industry, it will get 40% points; If the index reaches the poor level of the industry, score 30%; If it is lower than the poor level of the industry, it will get a score of 20%, and if it is between the two levels, it will be calculated by the difference method.

For multi-industry enterprises, if the benchmark financial basic data such as assets and income of a business segment can be calculated separately, and account for more than 30% of the total assets and income of the group enterprise, the corresponding industry standard values of no more than three business segments can be selected for evaluation respectively, and weighted summary can be made to form evaluation scores. If the business sector cannot be divided separately, the standard values of ten categories of the national economy or the standard values of the whole industry of state-owned enterprises can be directly selected for evaluation.

For the second-class commercial enterprises undertaking specific functional tasks, benchmarking evaluation can be carried out in combination with the specific task quantity and completion, but the maximum score weight of the evaluation of the completion of functional tasks does not exceed 50% of the benchmark evaluation weight, and the specific indicators (in principle, no more than two) and weights are specified in the responsibility book.

Public welfare enterprises can be scored against the six standard values (return on net assets, return on total assets, turnover rate of total assets, turnover rate of accounts receivable, asset-liability ratio and growth rate of sales [business]) of performance evaluation of enterprises in the same industry announced by the State Council State-owned Assets Supervision and Administration Commission, and can also be scored against the development level and quality of core indicators of main business in the same industry in China.

Financial enterprises shall be evaluated and scored in accordance with the Notice of the Ministry of Finance on Printing and Distributing the Measures for Performance Evaluation of Financial Enterprises (Caijin [2016] No.35).

If the standard value of financial performance is not used for benchmarking evaluation, the scoring rules shall be stipulated separately in the letter of responsibility.

2. Evaluation of improvement of short-board indicators 1-2 indicators are determined according to the specific situation of the enterprise for quantitative evaluation.

The score of short-board indicators is based on the completed value of the previous year. If there is improvement compared with the previous year, it will be scored according to the degree of improvement. If there is no improvement, it will not be scored. The specific indicators and weights are clearly defined in the responsibility book.

Third, the assessment and grading

The corresponding relationship between the comprehensive score of annual business performance assessment and the level is:

Grade A: Grade A ≥90, and the comprehensive evaluation opinions of the annual party committee secretary on the debriefing of grassroots party building or the assessment results of party style and clean government construction are "good" or "qualified" or above, and the return on net assets (the core index of the main business of public welfare enterprises) is ≥ the average level of the same industry;

Grade B: Grade B ≥75 points;

Grade C: 75 points > Grade C ≥60 points;

Grade d: 60 points > grade d ≥0 points.

Annex 2

Detailed Rules for Evaluation of Annual Reform and Development Indicators

Taking high-quality development as the core, combined with the functional orientation, industry characteristics and business characteristics of provincial enterprises, "one enterprise and one policy" determines the assessment indicators and weights, guides enterprises to implement new development concepts, changes development methods, implements innovation-driven, strengthens risk management and control, and realizes high-quality and sustainable development.

At the beginning of the year, by the board of directors of provincial enterprises in accordance with these rules, combined with the annual production and operation plan and strategic planning, around the aspects of industrial development, capital optimization, innovation breakthrough, etc., put forward the recommended values of the evaluation indicators of the enterprise’s reform and development, and the evaluation indicators of reform and development should not exceed six in principle, which will be included in the annual operating performance responsibility book or listed separately as an assessment annex after being examined and confirmed by the competent department. After the end of the year, the board of directors of the enterprise analyzes and summarizes the completion of the reform and development assessment indicators, forms a Summary and Analysis Report on the Completion of the Reform and Development Assessment Indicators, and submits it to the competent department. The competent department shall evaluate and score the completion of the annual reform and development indicators of the board of directors according to the summary and analysis report submitted by the enterprise and the daily work (100% system).

Industrial development indicators: including but not limited to supply-side structural reform, transformation and upgrading, development of new industries, key tasks and major projects assigned by the provincial party Committee and government and competent departments.

Capital structure optimization indicators: including but not limited to mixed ownership reform, asset securitization, and leverage reduction (asset-liability ratio).

Innovation breakthrough: including but not limited to innovation investment, innovation projects, innovation achievement transformation and other indicators in scientific and technological innovation, management innovation and mode innovation.

Annex 3

Detailed Rules for Scoring Performance Assessment of Term of Office

First, the comprehensive scoring formula for term performance evaluation

Comprehensive score of term business performance assessment = quality and benefit index score ×60%+ reform and development ability evaluation score ×30%+ year.

Degree of operating performance assessment results using x 10%+sigma assessment points-sigma assessment points.

Second, the term business performance evaluation index score

(a) the quality and efficiency index score (calculated by percentage system)

Quality and benefit index score of commercial enterprises = return on net assets score+maintenance and appreciation rate score of state-owned capital+asset-liability ratio score (financial enterprises score for deposit growth rate)

The basic scores of the return on net assets, the rate of preservation and appreciation of state-owned capital and the asset-liability ratio (deposit growth rate of financial enterprises) are 50 points, 30 points and 20 points respectively, and the arithmetic average of the three-year completion values of the return on net assets and the rate of preservation and appreciation of state-owned capital during the term of office has reached the three-year arithmetic average of five grades of the same industry standard values of "excellent", "good", "average", "low" and "poor" in the same period. In the last year, if the asset-liability ratio reaches five grades of the standard value of the same industry, namely "excellent", "good", "average", "low" and "poor", the score shall be calculated according to the coefficients of 1.2, 1.1, 1, 0.8 and 0.6 of the basic score respectively. Those who exceed the "excellent" value will be scored according to the basic score of 120%, and those who are lower than the poor value will be scored according to the basic score of 20%. If the completion value is between the upper and lower grades, the score shall be calculated according to the difference method.

Assessment score of quality and benefit indicators of public welfare enterprises = goal 1 score+goal 2 score+goal 3 score.

The evaluation of quality and benefit indicators of public welfare enterprises takes the average value of similar indicators in the same industry in the same period as the target value, that is, the scoring benchmark value. According to the importance of assessment indicators, the basic scores are 50 points, 30 points and 20 points respectively. If the assessment target is basically scored, and the assessment indicators reach five grades of "excellent", "good", "average", "low" and "poor" of the same industry standard value in the same period, the scores shall be calculated according to the coefficients of 1.2, 1.1, 1, 0.8 and 0.6 of the basic score respectively. Those who exceed the "excellent" value are scored according to the basic score of 120%, and those who are lower than the poor value are scored according to the basic score of 20%. If the completion value is between the upper and lower grades, the score shall be calculated according to the difference method.

(two) the reform and development ability evaluation score (calculated in percentage system)

It mainly evaluates the measures and implementation effects of supply-side structural reform, capital structure optimization, innovation-driven development, corporate governance, internal control and risk prevention during the term of office of the person in charge of the enterprise.

(3) Application of the results of the annual business performance assessment (calculated by percentage system)

The score is calculated by the arithmetic mean of the results of the business performance assessment in the three years during the term of office. If the term of office is less than three years, the score is calculated by the actual arithmetic mean of the year during the term of office, and if it exceeds 100 points, it will be counted as 100 points.

Third, the assessment and grading

The corresponding relationship between the comprehensive score of term business performance assessment and the level is:

Grade A: Grade A ≥90 points, and the comprehensive evaluation opinions of the Party committee secretary’s evaluation and assessment of grass-roots party construction in two years during his term of office or the assessment results of party style and clean government construction are all "good" or "qualified" or above, and the return on net assets (the core index of the main business of public welfare enterprises) in at least two years is ≥ the average level of the same industry;

Grade B: Grade B ≥75 points;

Grade C: 75 points > Grade C ≥60 points;

Grade d: 60 points > grade d ≥0 points.

Annex 4

Detailed rules for evaluating the ability of reform and development during the term of office

According to the requirements of high-quality development, focusing on enhancing the competitiveness, innovation, control, influence and anti-risk ability of the state-owned economy, combined with the strategic planning of enterprises, this paper evaluates the measures and achievements of promoting enterprise reform and development during the term of office of the board of directors of enterprises from five aspects: supply-side structural reform, capital structure optimization, innovation-driven development, corporate governance, internal control and risk prevention, so as to promote the board of directors of enterprises to stand on the present and focus on the long-term, continuously improve the quality and efficiency of enterprise development, and enhance enterprises.

At the beginning of the term of office, the board of directors of an enterprise shall, according to the functional nature and development strategy of the enterprise, formulate the Key Work Plan for the Reform and Development of the Board of Directors, including but not limited to the objectives, tasks, main measures, schedule and expected results, and submit it to the competent department, which will load it into the responsibility book of the term of office operating performance or list it as an assessment annex after examination and confirmation. At the end of the term, the board of directors of the enterprise forms a Summary and Analysis Report on the Key Work of the Reform and Development of the Board of Directors in light of the Key Work Plan for the Reform and Development of the Board of Directors’ Term and the responsibility book for operating performance, and submits it to the competent department, which evaluates and scores the reform and development of the board of directors in accordance with the summary and analysis report of the board of directors of the enterprise and the daily situation (100-point system).

I. Supply-side structural reform (weight 20%)

(1) Implementing the phased tasks of reform: including removing production capacity, "dealing with difficulties", reducing management levels, divesting social functions, and solving problems left over from history.

(2) Improving the quality of main business development: including all kinds of enterprises speeding up the transformation and upgrading of dominant traditional main businesses, commercial enterprises focusing on improving the quality and efficiency of development, and striving to achieve a return on net assets and an asset-liability ratio above the average level of the same industry; Public welfare enterprises strive to improve the supply capacity of public goods and service quality and efficiency, and strive to achieve the core indicators of their main business above the industry average.

(3) Optimizing the industrial product structure: It includes all kinds of enterprises, according to their functional orientation, actively adjusting their structure based on their own advantages and core technologies while developing their existing main businesses, developing new products and industries that meet the enterprise strategy and have market demand, and doing a good job in risk prevention and control of new products and industries.

Second, the capital structure optimization (weight 20%)

(1) Equity diversification: the plan, work schedule, safeguard measures and expected results of realizing equity diversification at all levels of enterprises and steadily developing mixed ownership economy;

(2) Listing or overall listing of enterprises: the plan, work schedule, safeguard measures and expected results of listing of enterprises.

Third, innovation-driven development (weight 20%)

(1) Innovation investment: including the growth level of investment in scientific and technological innovation, etc.;

(2) Innovation mechanism: including enterprise system reform, enterprise innovation talent construction, business model innovation effect, etc.;

(3) Innovative achievements: including the acquisition of major invention patents, awards for scientific and technological progress, and the transformation of innovative achievements.

IV. Corporate Governance (Weight 20%)

(1) Operating mechanism: including the division of functions and powers of the board of directors, the board of supervisors and the managers of the company, the effective operation of the board of directors and the situation of managing enterprises according to law, etc.;

(2) Decision-making efficiency of the board of directors: including the formulation and implementation of enterprise strategy, the scientific demonstration and implementation effect of major projects, the major deviation between enterprise financial budget and implementation, the authenticity and reliability of enterprise financial final accounts, the rectification and implementation of problems revealed by audit inspections, etc.;

(3) Group management and control level: including reasonable control of enterprise management level, reasonable definition of management boundary and authority of parent-subsidiary company, etc.

V. Internal control and risk prevention (weight 20%)

(1) System construction: including the construction of internal control system and risk management and control system;

(2) System implementation: including the operation status of internal control and risk management and control, etc.;

(3) System effect: including the effect of enterprise’s comprehensive risk prevention, etc.

Annex 5

Contents and signing procedures of responsibility book for business performance

I. Contents of Responsibility Letter for Operating Performance

(a) the name of the assessment and the assessed party;

(2) Assessment contents and indicators;

(3) Assessment, rewards and punishments;

(four) the rights and responsibilities of both parties;

(5) Alteration, rescission and termination of the responsibility letter;

(six) other matters that need to be agreed.

Second, the operating performance responsibility book signing procedures

(a) submit the assessment objectives and suggestions. At the beginning of the assessment, the board of directors of provincial enterprises shall, in accordance with these measures and the requirements of the competent department for business performance assessment, submit the suggested values of assessment objectives and necessary explanatory materials during the assessment period to the competent department after deliberation and approval by the board of directors.

(two) determine the assessment content. The competent department shall review the proposed assessment target value put forward by the enterprise, and determine the assessment target value and related contents after communicating with the board of directors of the enterprise.

(three) the annual (term) business performance responsibility letter signed with the assessed party.

Annex 6

Description of relevant indicators for business performance assessment

First, the annual target assessment indicators

(1) Total profit refers to the total profit in the annual profit statement of the group enterprise, plus the sum of the deemed profits. The basic data is taken from the consolidated Income Statement. This indicator assesses the annual operating results of the enterprise.

(2) Economic Value Added (EVA) refers to the balance of net operating profit after tax minus the cost of capital. Data are taken from Balance Sheet, Income Statement and related financial statements. This index evaluates the ability of enterprises to create value by using shareholder capital and debt capital.

Economic added value = net operating profit after tax-cost of capital

Cost of capital = adjusted capital × average cost rate of capital

Net operating profit after tax = net profit+(interest expense+R&D expense adjustment item) ×(1- enterprise income tax rate)

Adjusted capital = average owner’s equity+average total liabilities-average interest-free current liabilities-average construction in progress

Interest expense refers to "interest expense" under "cost expense" in enterprise financial statements.

The adjustment item of R&D expenses refers to "R&D expenses" under "cost expenses" in enterprise financial statements.

Interest-free current liabilities refer to notes payable and accounts payable, advance receipts, taxes payable, employee salaries payable, other payables and other current liabilities (excluding other interest-bearing current liabilities) in the financial statements of enterprises. For "long-term payables" and "special reserve funds", they can be deducted as interest-free current liabilities.

Construction in progress refers to the "construction in progress" in the financial statements of enterprises.

The capital cost ratio of commercial enterprises is determined to be 4%.

The capital cost ratio of commercial second-class enterprises is determined to be 3.5%.

The capital cost ratio of public welfare enterprises is determined to be 3%.

If the asset-liability ratio exceeds the control standard set by the competent department, the capital cost ratio will rise by 0.5%; Every time it exceeds the control standard of the competent department by 5%, it will rise by 1%.

If assets reorganization, major policy changes, force majeure and incomparable factors have a significant impact on the assessment of economic added value of enterprises during the assessment period, they shall be adjusted according to the facts.

(III) The profit rate of operating income refers to the ratio of the operating profit in the annual consolidated Income Statement of the Group divided by the total operating income.

Second, the term target assessment indicators

(a) the return on net assets refers to the arithmetic average of the return on net assets in three years during the term of office. The annual return on net assets is calculated by dividing the annual net profit of the enterprise by the average net assets of the current year, and the data is taken from the consolidated Balance Sheet and Income Statement of the enterprise every year during the term of office. Excluding minority shareholders’ equity and profit and loss.

Term ROE = sum of ROE of three years /3

Annual return on net assets = annual net profit/annual average net assets ×100%

(2) The rate of maintaining and increasing the value of state-owned capital refers to the arithmetic average of the rate of maintaining and increasing the value of state-owned capital in three years during the term of office. Divide the balance attributable to state owners’ equity at the end of each year by the equity attributable to state owners at the beginning of the year after deducting the objective increase and decrease factors that occurred during the year. The data are taken from the Statement of Changes in Owners’ Equity, the Statement of Changes in State-owned Assets and the explanatory materials for the verification of the preservation and appreciation of state-owned capital.

The rate of maintaining and increasing the value of state-owned capital during the term of office = the sum of the rates of maintaining and increasing the value of state-owned capital in three years /3

Annual state-owned capital preservation and appreciation rate = state-owned capital at the end of the year/state-owned capital at the beginning of the year after deducting the influence of objective factors ×100%.

(three) the asset-liability ratio refers to the level of assets and liabilities in the last year of the term of office. Divide the total liabilities by the total assets in the last year of the term of office, and the data will be taken at the end of the last year of the term of office.

Term asset-liability ratio = asset-liability ratio at the end of the last year of term.

(four) the deposit growth rate of financial enterprises refers to the arithmetic average of the deposit growth rate of three years during the term of office. Divide the new deposits each year during the term by the deposits at the beginning of the year. Data are taken from the Balance Sheet and Income Statement of each term.

Term deposit growth rate = sum of three annual deposit growth rates /3

(V) Target indicators of public welfare enterprises Select business core indicators according to the nature of the enterprise’s main business, and specify them in the responsibility book after confirmation. In principle, there are no more than three assessment indicators.

Annex 7

Detailed Rules for Adding (Deducting) the Score of Business Performance Assessment

First, on the basis of the annual and term assessment scores, if the enterprise has the following matters during the assessment period, it will directly reward the annual or term assessment with extra points, and the extra points will not be restricted by other provisions in these Measures, and the total extra points for the annual and term will not exceed 10 points respectively.

(A) provincial enterprises have made significant achievements in innovation.

1 enterprises won the first, second and third prizes of national scientific and technological progress in the year, with 4, 3 and 2 points respectively; Won the first, second and third prizes for scientific and technological progress in Yunnan Province, with an annual score of 2, 1 and 0.5 respectively; The same award is subject to the highest award; The term of office is halved.

2 enterprises won the national quality award in the year, plus 2 points in the year; Won the provincial and ministerial quality award, the annual plus 0.5-1 points; The same award is subject to the highest award; The term of office is halved.

(two) to complete the major special tasks assigned by the provincial government and the competent department.

1 to complete the major special tasks assigned by the provincial government and the competent department, depending on the situation, add 1-3 points annually.

2 to complete the listing task (except those that have been included in the assessment of reform and development indicators), depending on the situation, add 1-2 points each year.

(3) Actively participate in society and make significant contributions.

1. If the tax payable by the enterprise in that year exceeds 1 billion yuan, add 1 point for the year; More than 2 billion yuan, plus 2 points per year; More than 3 billion yuan, plus 3 points per year.

2 annual state-owned capital operating income turned over to the top 3, plus 2 points.

3 enterprises to promote employment of more than 50 thousand people and above, plus 1 points a year; If the enterprise drives the employment of more than 100,000 people and above, 2 points will be added annually; If the enterprise drives the employment of more than 200,000 people and above, add 3 points for the year.

4 enterprises in poverty alleviation work outstanding achievements, commended by the provincial government, depending on the circumstances of the year plus 1-2 points.

(4) Other matters.

1. The annual Party committee secretary of the enterprise pays attention to the comprehensive evaluation opinions of the grass-roots party building debriefing assessment, which is characterized as "good" year plus 5 points, and is characterized as "better" year plus 2 points; The term of office shall be calculated according to the arithmetic average of bonus points in each year during the term of office.

2. If the return on net assets of the enterprise in that year exceeds the national excellent level in the same industry, 2 points will be added for the year; More than 1 times the national excellent level of the same industry, plus 4 points each year.

3. If the domestic credit rating of an enterprise is maintained at AAA or the original rating is lower than AA+ and upgraded to AA+ and above, add 3-5 points annually; The term of office is halved.

4 other points identified by the competent department, depending on the circumstances of the year plus 1-5 points; The term of office is halved.

Second, on the basis of the annual and term assessment scores, if the enterprise has the following matters during the assessment period, the annual or term assessment score will be deducted or downgraded, and the points will not be restricted by other provisions in these Measures. The total points deducted for the annual and term are not more than 10 points respectively.

(1) Safety accidents and environmental incidents

In case of major and above production safety accidents, major and above ecological and environmental incidents and serious quality accidents, 1-10 points will be deducted or the assessment level will be directly lowered; The term of office is halved.

(B) financial fraud

If an enterprise violates the Accounting Law of People’s Republic of China (PRC), Accounting Standards for Business Enterprises and other relevant laws, regulations and rules, falsely reports or conceals its financial status, and it is found that it has caused significant adverse effects or losses of state-owned assets, it will be deducted 5-10 points depending on the situation or directly reduce the assessment level; The term of office is halved.

(C) Comprehensive management of stability (safe construction) responsibility events

Enterprises have major letters and visits, comprehensive management and stability (safe construction) responsibility events, which seriously affect the production and life order of enterprises or cause negative social impact, depending on the situation, 1-10 points will be deducted annually or the assessment level will be directly reduced; The term of office is halved.

(4) Violation of laws and regulations

1. If the legal representative of the enterprise or the relevant person in charge violates the national laws, regulations, articles of association and management regulations, resulting in the loss of state-owned assets, 1-10 points will be deducted annually or the assessment level will be directly lowered; The term of office is halved.

2. If the person in charge of the enterprise has a major violation of discipline and law, 1-10 points will be deducted annually or the assessment level will be directly reduced; The term of office is halved.

(five) illegal decision-making and indiscriminate investment caused the loss of state-owned assets.

If the person in charge of the enterprise makes illegal decisions and invests indiscriminately, it will be deducted 1-10 points each year depending on the situation; The term of office is halved.

(6) Other matters.

1. The annual party committee secretary of the enterprise grasps the comprehensive evaluation opinions of the grass-roots party building debriefing appraisal, which is characterized as "general" and deducted 3 points for "poor" years; The term of office is calculated according to the arithmetic average of deduction points in each year during the term of office.

2. Deduct 4 points for the year of "basically qualified" and 5 points for the year of "unqualified"; The term of office is halved.

3. In the enterprise year, due to the wage payment of migrant workers, unexpected events occur or are punished by the relevant departments of the state, province and province, etc., depending on the situation, 1-10 points will be deducted or the assessment level will be directly reduced; The term of office is halved.

4. If the key tasks arranged by the provincial party committee, the provincial government or the provincial SASAC and the competent department are poorly completed, 1-10 points will be deducted annually or the assessment level will be directly reduced; The term of office is halved.

5. If the enterprise fails to turn over the operating income of state-owned capital in full within the specified time, or the difference between the budgeted amount and the actual turned-over amount is quite large, 1-5 points will be deducted as the case may be.

6. Deduct 3-5 points for the year when the domestic credit rating of the enterprise declines; The term of office is halved.

7 state-owned holding enterprises have the conditions for profit distribution, but they have not made profit distribution or the distribution ratio is lower than that stipulated in the state-owned budget for wholly state-owned enterprises, and the annual deduction is 0.5-1 point.

8 other points identified by the competent department, depending on the circumstances of the annual deduction of 1-10 points or directly reduce the assessment level; The term of office is halved.