Wentuan CICC

The contradiction between the high growth of power demand and the constraint of energy consumption index is emerging.

Power cuts and industrial peak-shifting production have once again occurred in various places.

Inner Mongolia, Yunnan and Guangdong have a tight balance of power, which "reproduces peak-shifting production". In December, 2020, power cuts occurred in Zhejiang, Hunan, Jiangxi, Inner Mongolia and other places, requiring industrial and commercial enterprises to produce off-peak to fill the valley; Since May 2021, power cuts have been staged again in Guangdong and Yunnan. Guangdong government will strengthen load trend forecasting and analysis and guide enterprises to adjust production arrangements and peak electricity consumption; On May 10th, Yunnan, due to the lower-than-expected incoming water, there was a gap in the peak electricity consumption, which led to the start of off-peak power rationing for enterprises and reduced the electricity load of electrolytic aluminum plants by more than 30%. China Southern Power Grid informed the electrolytic aluminum plants that the power rationing is expected to last until mid-June.

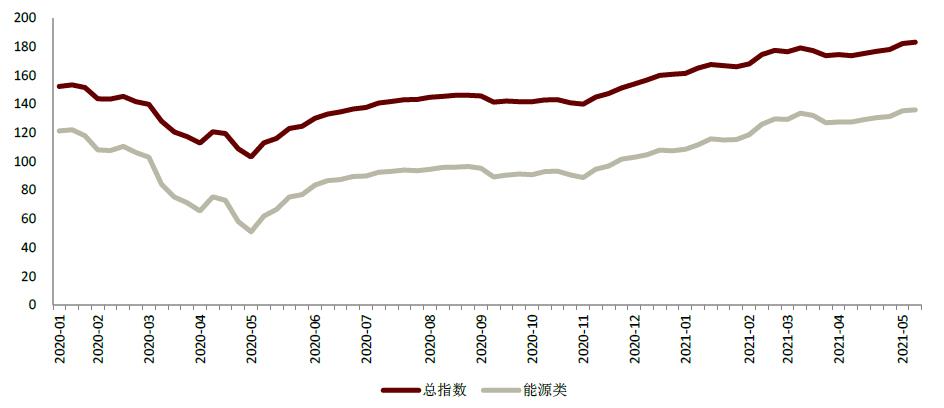

Tight supply pushes up bulk prices and affects the production cost of economic activities. The epidemic led to a continuous decline in commodity prices in early 2020, followed by economic stimulus policies in various countries, and prices bottomed out in April-May. On May 14th, 2021, the total index of commodity prices in China reached 183.3, up 43.6% from last year’s rock-bottom price of 103.3. In May, the National People’s Congress named the issue of commodity prices for two consecutive weeks [1]. Although the price dropped after May 14th, the factors driving the price increase have not been eliminated. Moreover, after the high temperature weather entered in June, the supply reduction caused by power cuts may further expand, and commodity prices may remain at a high level for a long time.

Chart: China Commodity Price Index (Week)

Source: wind information, Research Department of CICC.

The main cause of power rationing

1) Industrial and commercial electricity consumption exceeded expectations, and the power load hit a historical high:

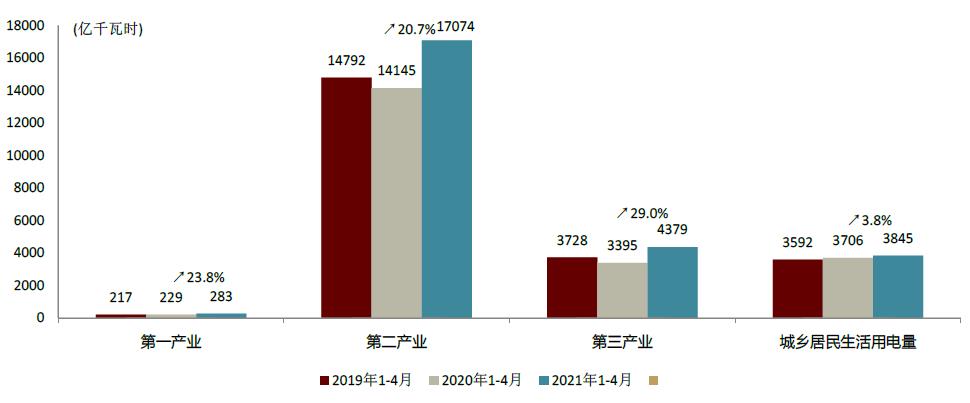

Economic recovery brought about a sharp increase of 19.1% in electricity consumption in the first four months, and the contribution of secondary and tertiary industries was 66.7% and 17.1%. From January to April, the electricity consumption of the whole society in China increased rapidly by 19.1% year-on-year, which was 7.0% higher than the same period in 2019, excluding the impact of the epidemic; Among them, the contribution rates of secondary and tertiary industries were 66.7% and 17.1%, respectively, up 20.7% and 29.0% year-on-year, with compound growth rates of 7.4% and 8.4% compared with the same period in 2019, and the growth rate of electricity demand exceeded the expected level.

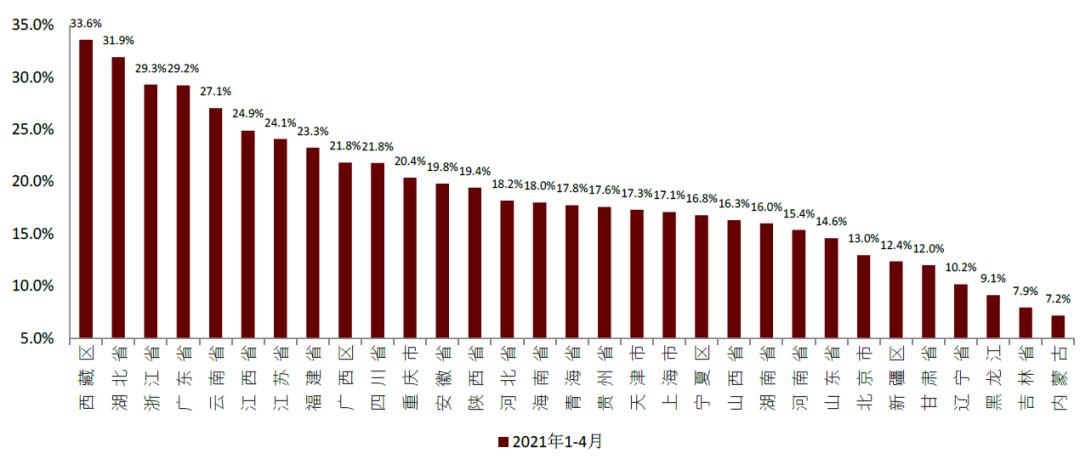

High demand for electricity is a national pressure, and the year-on-year growth rate of 13 provinces exceeds the national average. Xizang, Hubei, Zhejiang and Guangdong have the highest year-on-year growth rates from January to April, accounting for 33.6%, 31.9%, 29.3% and 29.2% respectively. Compared with the same period in 2019, the compound growth rate is between 2.7% and 16.5%, and the compound growth rate of 16 provinces exceeds the national average, with Yunnan, Xizang, Shandong and Guangxi leading the way, accounting for 16.5%, 14.9%, 10% and 10% respectively.

Guangdong’s power load exceeded 100 million ahead of last year, and the rising peak demand aggravated the shortage of power. With the economic growth after the resumption of work and the air conditioning load brought by the rising temperature, the peak load of Guangdong power grid took the lead in breaking 100 million on March 19, 9 days earlier than the same period last year. The trend of power peak load has brought great challenges to the installed power reserve, power grid forecasting and dispatching ability in various regions.

Chart: China’s electricity demand from January to April in 2019-2021-by industry

Source: China Electricity Council, Research Department of CICC.

Chart: Year-on-year growth rate of electricity demand in China from January to April 2021-by region

Source: Government website, Research Department of CICC.

2) Power supply shortage: the power supply is in a tight situation due to the influence of weak incoming water, weak sunshine and high coal price.

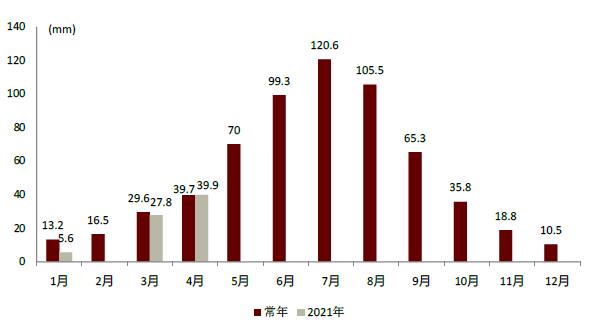

Since 2021, dry weather has occurred in many places in Jiangnan and South China. From January to April 2021, the power generation of hydropower plants above designated size was 272.7 billion kWh, up by 1.1% year-on-year, and the compound growth rate was -4.5% compared with the same period in 2019. On a monthly basis, the average precipitation in January decreased by 58% compared with the normal period, and gradually recovered and approached the normal period from February to April, but the flood season in South China was 20 days later than normal. In May, the precipitation in southwestern Sichuan, northwestern Yunnan and eastern South China was still less, and the drought continued.

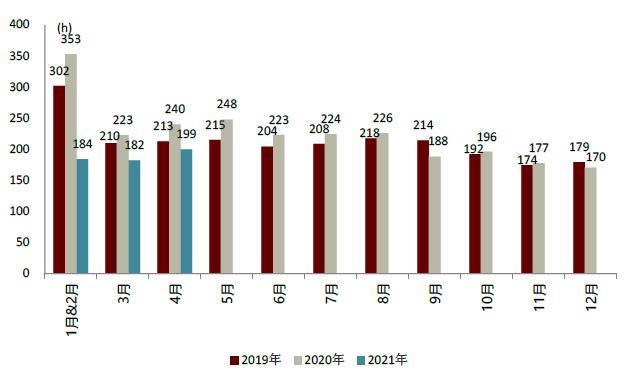

Due to the increase of fog and dusty weather, the sunshine is weak. According to the agricultural meteorological news, the sunshine hours in March were 182h, which was 18.4% and 9.4% less than that in the previous year and the same period of normal years. Among them, southwest and south China are 30% to 1 times more, and central North China, western Huanghuai, Jianghan, western Jiangnan and northwestern South China are 30% to 50% less. In April, the number of sunshine hours in China was 199h hours, which was 16.9% and 7.7% less than that in the previous year and the same period of the previous year, and it was 20% to 80% less than that in the eastern northwest, southwestern north China, Jianghan, central and western south China, western south China and eastern southwest China.

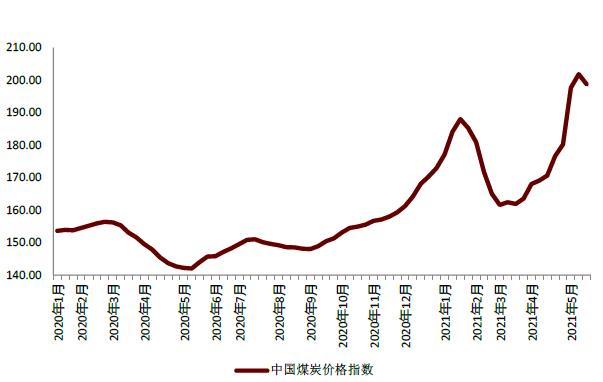

The price of thermal coal continues the upward trend at the end of 2020, and the cost pressure of thermal power enterprises is great. From January to April 2021, the thermal power generation of power plants above designated size increased by 19.9% year-on-year, with a compound growth rate of 6.9% compared with the same period in 2019. The strong demand for electricity pushes up the demand for coal and the price trend of thermal coal. The cost of spot coal is close to the on-grid electricity price, and the profit situation of power generation is not optimistic.

Chart: Monthly change of precipitation in China

Source: China Meteorological Bureau; Research department of CICC

Note: Data in February 2021 are not disclosed.

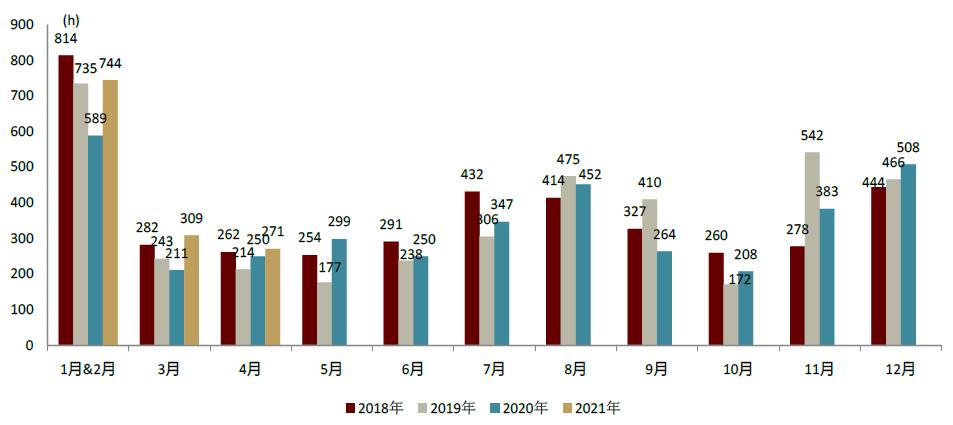

Chart: Monthly change of sunshine hours in China

Source: National Agrometeorological Monthly Report; Research department of CICC

Note: January-February 2021 is February data.

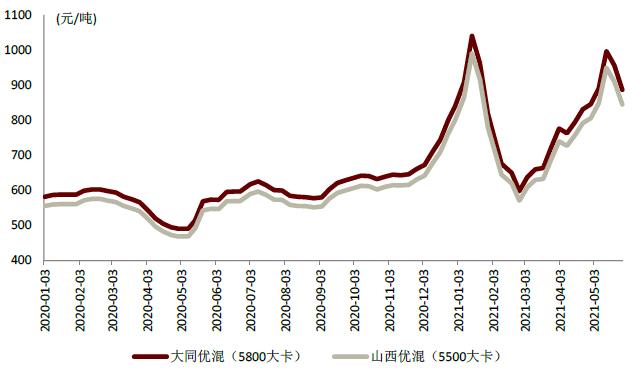

Chart: China coal price index

Source: wind information; Research department of CICC

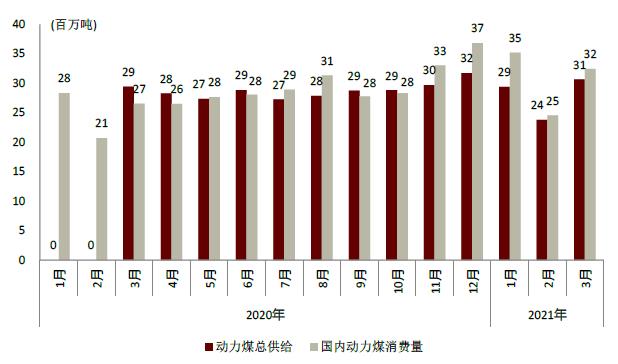

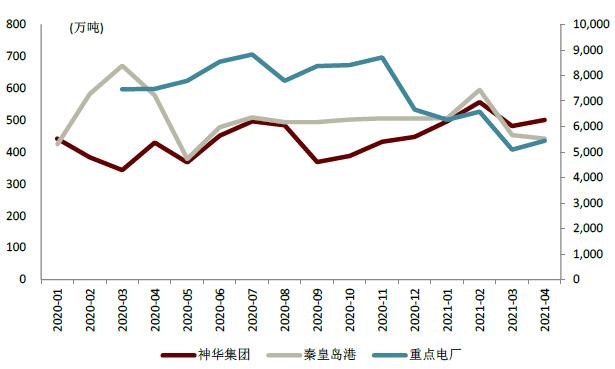

Chart: China’s coal supply and demand situation

Source: wind information; Research department of CICC

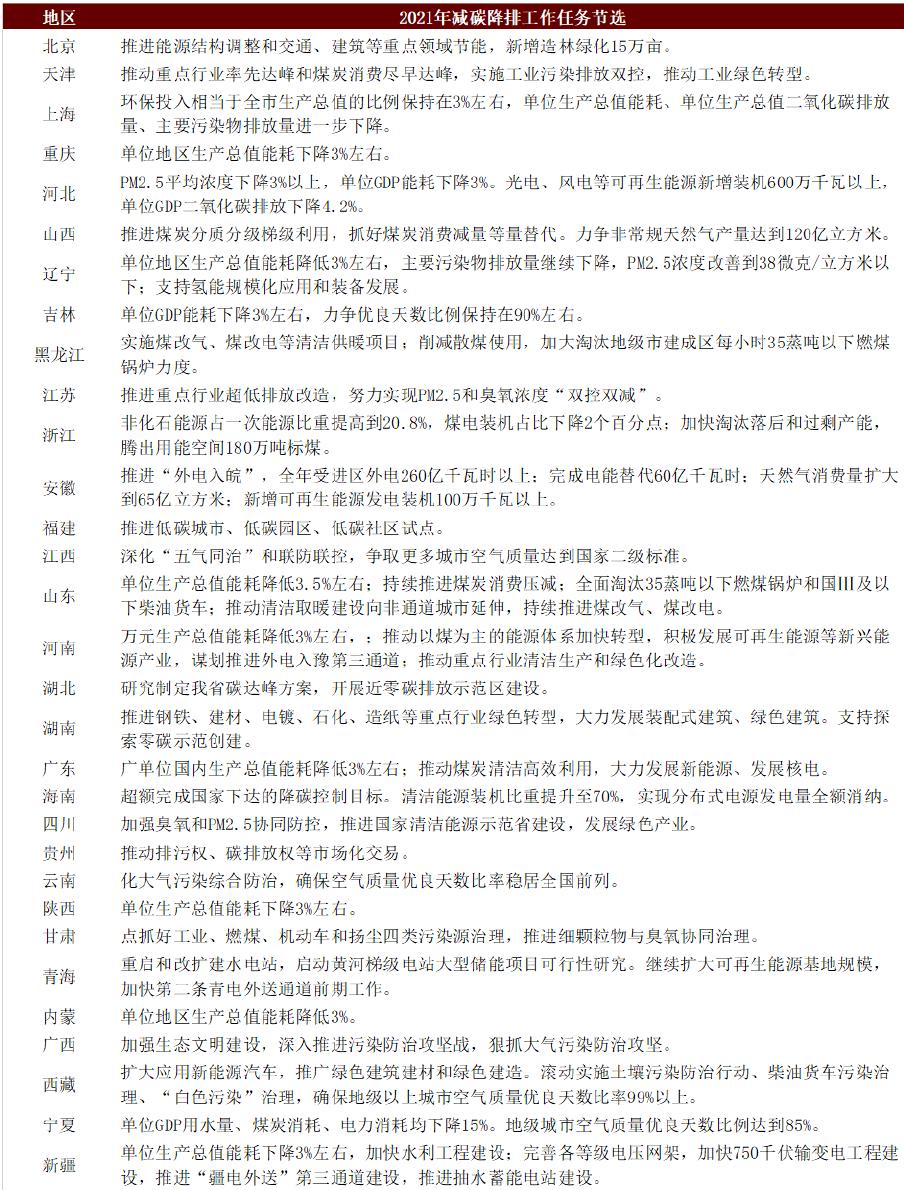

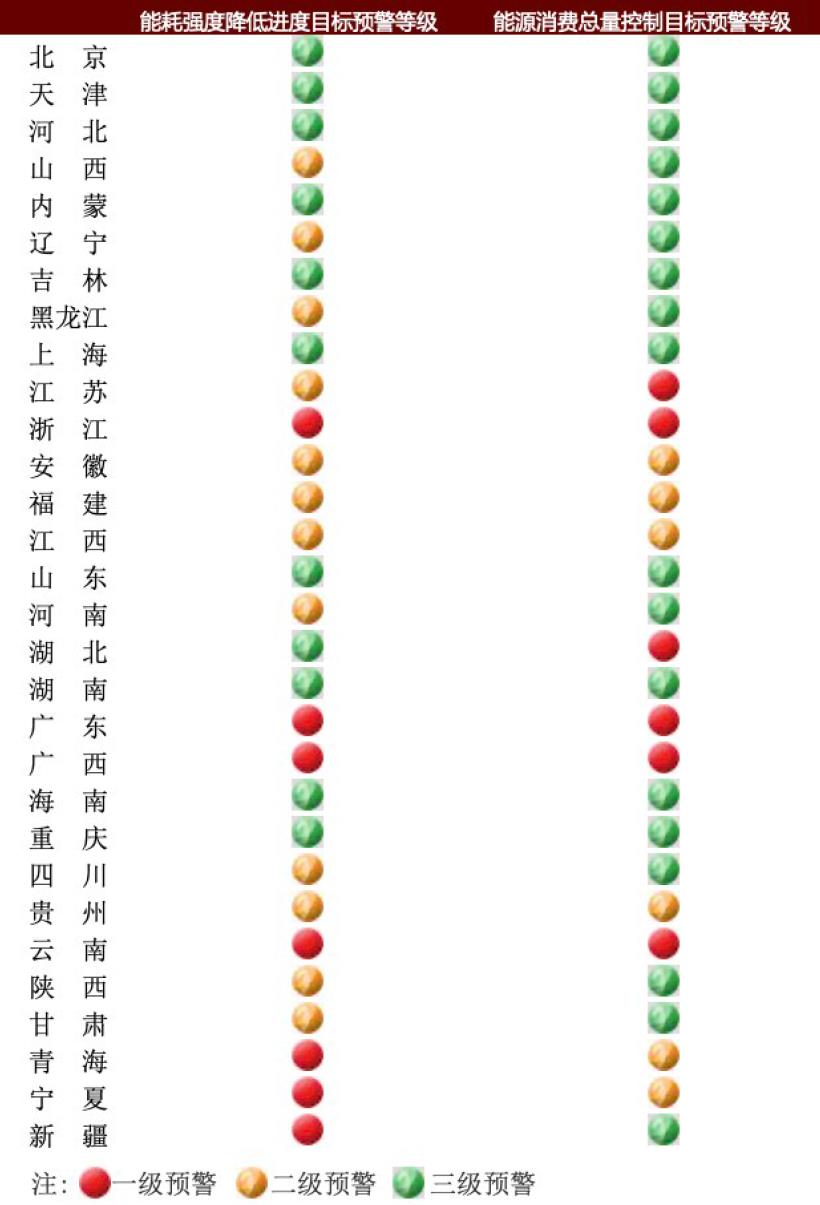

3) The pressure of energy consumption management and control in many provinces is rising, facing interviews.

Clean energy is restricted by natural factors, and the power generation fails to meet the demand increase. Thermal power supports the power supply in dry season, and the contradiction with the energy consumption index is prominent. The General Office of the National Development and Reform Commission issued the Notice of "Barometer on the Completion of the Target of Dual Control of Energy Consumption in the First Quarter of 2021", in which the energy intensity of Zhejiang, Guangdong, Guangxi, Yunnan, Qinghai, Ningxia and Xinjiang increased instead of falling, and was reminded by the NDRC. Since the beginning of the year, the work reports of provincial governments have all proposed that energy conservation, carbon reduction and emission reduction should be controlled within the targets set by the state in 2021. Zhejiang, Ningxia and Xinjiang have set the targets of "freeing up 1.8 million tons of standard coal for energy use", "the consumption of water, coal and electricity per unit of GDP has decreased by 15%" and "the energy consumption per unit of GDP has decreased by about 3%" in 2021. According to the year-on-year increase of energy consumption intensity in the first quarter, it is obvious that.

Chart: Excerpts from the work reports of provincial governments on energy conservation and emission reduction targets in 2021.

Source: websites of provincial governments and research department of CICC.

Chart: barometer of the completion of energy consumption double control targets in the first quarter of 2021

Source: National Development and Reform Commission and Research Department of CICC.

Short-term measures: it is crucial to increase the output of clean energy and increase the supply of coal.

Priority is given to the proportion of low-carbon clean energy consumption.

The utilization rate of existing clean energy projects has obviously rebounded, and the absorptive capacity of wind power photovoltaic needs to be further improved.

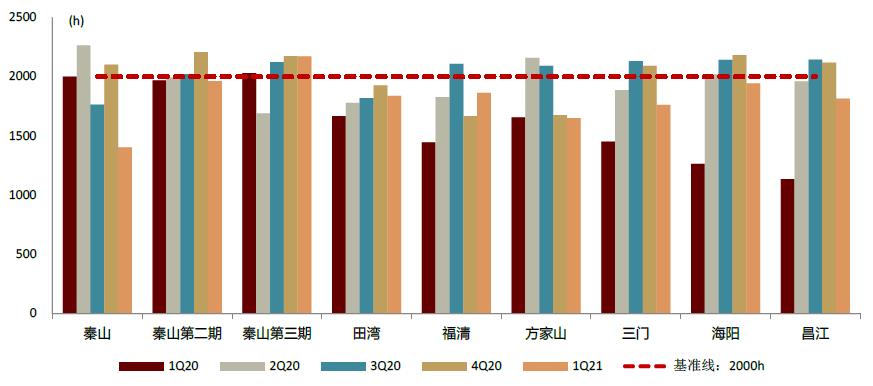

Since the second half of last year, nuclear power units have tended to be full: by the end of 2020, the installed power generation of nuclear power in China has increased by 5.0% year-on-year, and the utilization hours have increased by 1.4% year-on-year to 7453 h; From January to April in 2021, the installed capacity increased by 4.7% year-on-year, the power generation increased by 14.9% year-on-year, the growth rate increased by 11.2 percentage points over the same period of last year, and the utilization hour increased by 9.9% year-on-year to 2450h, and the utilization rate rebounded obviously. Among them, the quarterly utilization hours of 3Q20 and 4Q20 nuclear power units in China exceeded 2000 hours, which were 2038h and 2015h respectively, and they have tended to be full; 1Q21 was 1822h, an increase of 12.25% over the same period of last year.

Chart: Quarterly utilization hours of nuclear power units in China.

Source: Company Announcement, Research Department of CICC.

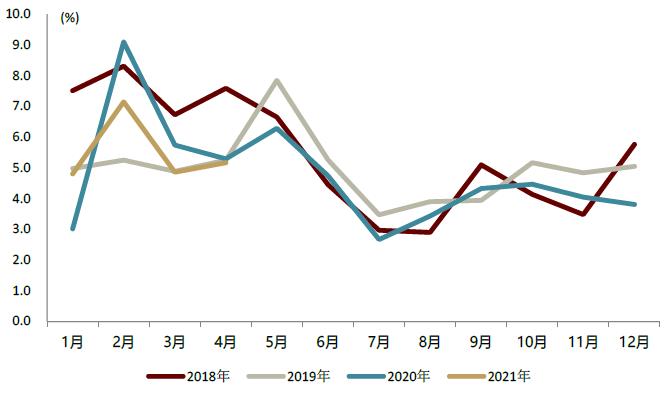

Since the beginning of this year, the wind conditions have been good and the power cut has continued to improve. From January to April 2021, Longyuan Power’s wind power generation increased by 23.3% year-on-year. Excluding the reasons of wind resources last year, we can see that the data has a compound growth rate of 14.1% compared with the same period in 2019. In addition, the company’s power cut rates in the first four months were 4.8%, 7.2%, 4.9% and 5.2% respectively, which remained at a low level in the same period of the past four years after the industry rushed to install them last year.

Chart: Monthly Change of Power Limit Rate of Longyuan Power Company

Source: Company Announcement, Research Department of CICC.

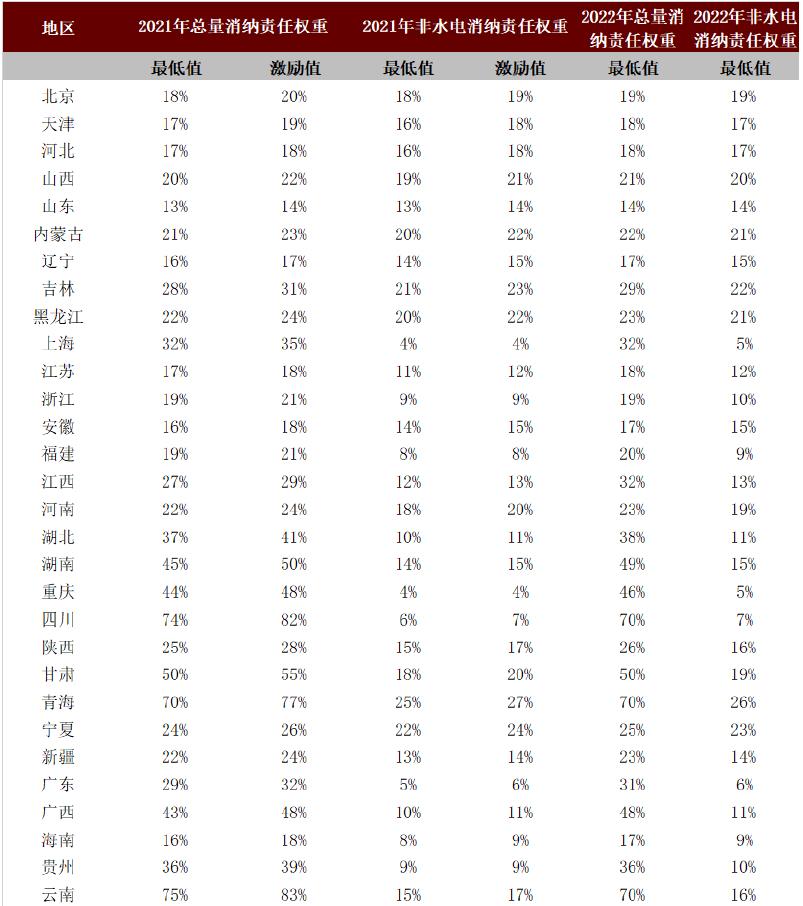

The release of non-water renewable energy consumption indicators will promote sustainable construction and grid-connected scenery projects. Recently, the Notice on Matters Related to the Development and Construction of Wind Power and Photovoltaic Power Generation in 2021 and the Notice on the Responsibility Weight of Renewable Energy Power Consumption and Related Matters in 2021 were issued. The target of wind power and photovoltaic power generation in 2021 is about 11% of the total electricity consumption, and the binding non-hydropower consumption responsibility weight of each province is between 4.0% and 24.5%, and the expected target in 2022 is 5.3%. Under the guidance of this goal, the speed of scenery stock and new projects from filing to construction and production will be accelerated and the cycle will be shortened.

Chart: China’s Provinces Consume Responsibility Weight

Source: website of National Development and Reform Commission, Research Department of CICC.

Increase coal supply and push down prices.

High coal prices limit the ability and willingness of thermal power generation. According to industry exchanges, the loss of coal-fired power business of mainstream thermal power enterprises has reached 20-30% in the first quarter. Entering the off-season of traditional power generation in the second quarter, the growth rate of power generation is slightly weaker than that of the previous quarter, but the high coal price may further worsen the profit performance and expand the loss.

After urging the thermal coal to increase the supply and protect the price, the price dropped slightly. On May 19th, the executive meeting of the State Council pointed out that it is necessary to attach great importance to the adverse effects caused by rising commodity prices and urge key coal enterprises to increase production and supply on the premise of ensuring safety. Shaanxi has increased the output of Shaanxi Coal Group, an existing large coal enterprise, and at the same time accelerated the construction of coal mines and increased production capacity. In terms of price stabilization, Yulin City, Shaanxi Province held a meeting to ensure supply and price stabilization, and interviewed the heads of major local coal enterprises, asking them to reasonably control coal prices and put an end to hoarding and other acts of driving up coal prices [2]. After May 14, the price of coal in Qinhuangdao has declined. In order to solve the contradiction between supply and demand of coal for a long time and restore the rational range of the market, it is necessary for coal enterprises to increase the release of production capacity.

Chart: Monthly data of coal inventory

Source: wind information, Research Department of CICC.

Chart: Closing Price of Zhou Du Coal in Qinhuangdao (including tax).

Source: China Coal Resources Network, Research Department of CICC.

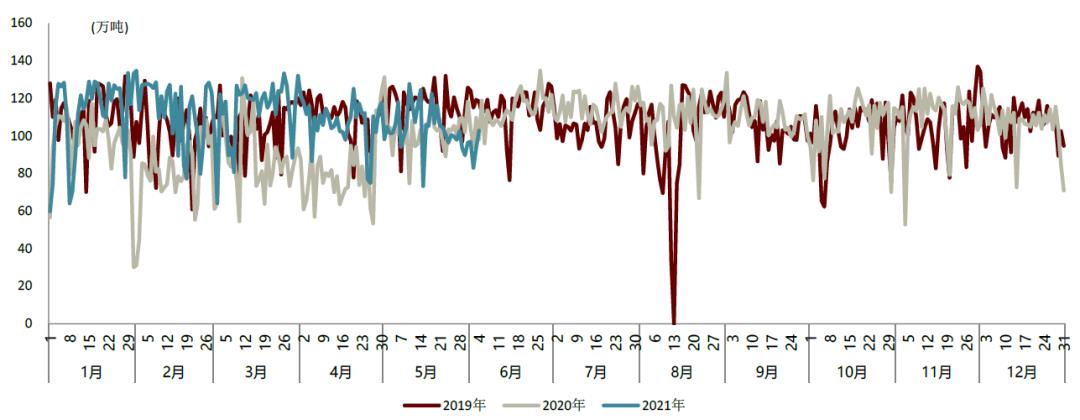

Chart: Coal throughput of Qinhuangdao and Huanghua ports in China since 2019

Source: wind information, Research Department of CICC.

Long-term measures: the power system will reshape the electricity price mechanism or usher in a new situation

Peak power shortage or new normal

In the past five years, the average utilization hours of thermal power installed capacity have remained at 4,164.7 ~ 4,361.0 hours, showing a state of increasing first and then decreasing, which is far lower than the 5,500 hours showing the shortage of electricity in the region. Looking at the one-year cycle, our power supply is still in a relatively loose state.

Then what are we talking about lack of electricity? There is a lack of power installed capacity to meet the power demand at rush hour. Power cuts are frequent in many provinces and cities, but we also find that Guangdong, Hunan, Yunnan and other places with problems often have several characteristics:

On the basis of the high increase of industrial and commercial electricity consumption after the resumption of work, "cold winter and hot summer" brought the electricity consumption of air conditioning to rise ahead of schedule, and the difference between peak and valley was obvious. With the increase of urbanization, industrialization and electrification rate, air conditioning is used more and more frequently in industry and people’s livelihood. Cooling in summer and heating in winter amplify the influence of climate on power demand. At the end of last year, the winter in Hunan Province came early, and the average temperature was 3℃ lower than that in the same period, which led to a rapid increase in the load. Since May this year, the high temperature in Guangdong Province has continued, which is 4℃ higher than that in the same period last year. When the industrial and commercial demand is growing rapidly, extreme weather further increases the difficulty for relevant departments to forecast the power shortage in advance and flexibly dispatch the power grid.

The proportion of clean energy (hydropower, wind power, photovoltaic) affected by natural conditions is relatively large in the power supply structure. From the point of view of power supply, in addition to the stability of thermal power and nuclear power generation, water, wind and light are affected by the wet/dry season and the natural conditions of the year. Imagine that if the annual dimension of incoming water is more stable than in previous years, but if the dry season is good and the flood season coincides with the peak of summer electricity consumption is much weaker than expected, even if the thermal power is full, it will be difficult to make up, and the supply and demand will not match in the short term, and there will be a power gap.

Take Hunan 4Q20 as an example: the utilization hours of thermal power in Hunan remained at the level of 4,000 hours in 2018-2019. At first glance, there is still room for dispatching power generation. But in detail, the monthly utilization hours of thermal power in the province are between 200-300 hours from March to June, with an annual utilization of 2,400-3,600 hours, which is not full, while in the summer of peak electricity consumption (July-September), the thermal power units can reach 300-400 hours, with an annual utilization of 3,600-4,800 hours, while The rapid increase in power demand makes it difficult to obtain additional power supply support.

Chart: Hunan Province-Monthly thermal power utilization hours fluctuate greatly.

Source: China Electricity Council and Research Department of CICC.

Tightly balance the power supply, improve the power price mechanism and enhance the investment attraction.

The call for "price reduction" of the two sessions has weakened. In order to reduce the cost of enterprises, in 2018-2019, the general industrial and commercial electricity price will be reduced by 10% and 10% on average, and in 2020, the industrial and commercial electricity price will be reduced by 5%. In 2018 and 2019, the general industrial and commercial sales electricity price decreased by 0.15 yuan/kWh, with a cumulative decrease of 19%. In 2021, although it was proposed to continue to reduce the general industrial and commercial electricity price, no binding instructions were given for the reduction, and the focus of reducing the customer-side electricity price was on the transmission and distribution price and the price increase in the process of switching to power supply, which weakened the hard demand for reducing the on-grid electricity price of power generation enterprises.

Under the pressure of high coal prices, market-oriented electricity price discounts are improving, especially in Jiangsu, Shandong, Yunnan and Guangdong. In 2021, the electricity market will be extended to all manufacturing enterprises, and the degree of marketization will be further expanded. In the past, when the supply of electricity exceeded the demand, the market-oriented transaction price was obviously lower than the benchmark on-grid price, and the profit-making effect of power generation enterprises was obvious. However, in the case of tight power supply and demand in 2021, the bidding price has increased significantly and the power discount has narrowed.

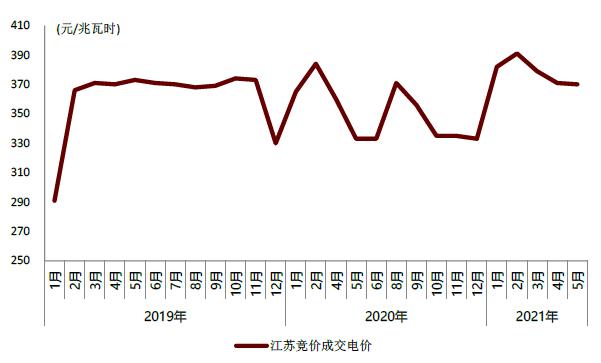

Jiangsu: In February this year, the transaction price reached 391 yuan/mwh, the highest value since 2018. The average transaction price from January to June was 378 yuan/mwh, up by 23 yuan/mwh compared with the same period of last year, and up by 21 yuan/mwh compared with the same period of 2019.

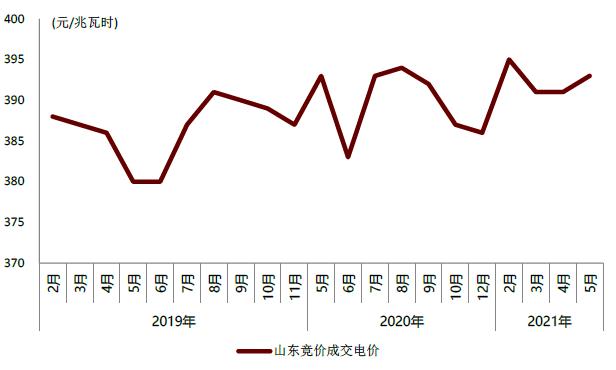

Shandong: In February and June this year, the transaction price reached a historical peak of 395 yuan/mwh, and the average price from January to June was 393 yuan/mwh, up by 9 yuan/mwh compared with the same period in 2019.

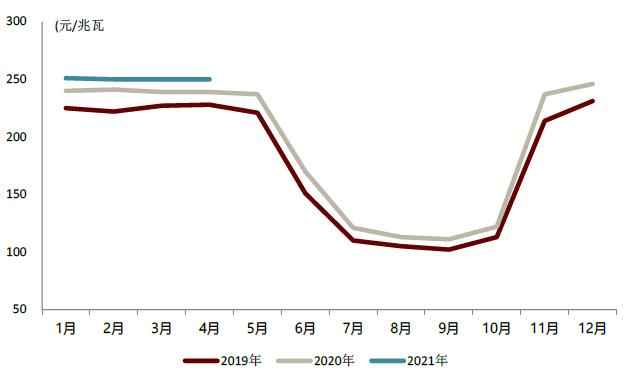

Yunnan: From January to May this year, the transaction price remained above 250 yuan/MWh, and the average price increased by 10 yuan/MWh compared with the same period of last year.

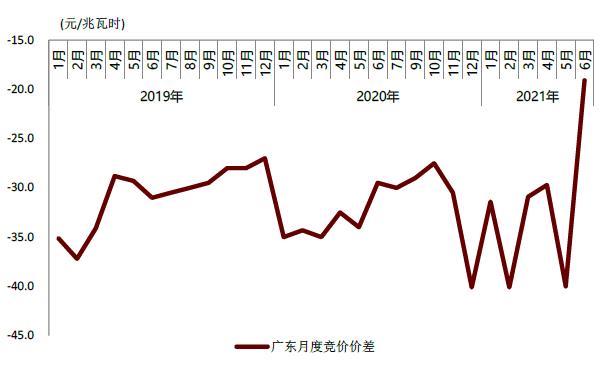

Guangdong: From January to May this year, the monthly bidding price difference was 29.7-40.1 yuan/mwh, with an average of 34.4 yuan/mwh, which was similar to the 4Q20 price difference range of 27.5-40.1 yuan/mwh and the average of 32.7 yuan/mwh, but in June, the bidding price difference fell to the lowest value of 1.91 yuan/mwh. Or due to the tight power supply and the peak electricity consumption in June.

Chart: Jiangsu Bidding Transaction Electricity Price

Source: Electric Power Trading Center; Research department of CICC

Chart: Shandong bidding transaction price

Source: Electric Power Trading Center; Research department of CICC

Chart: Yunnan bidding transaction price

Source: Electric Power Trading Center; Research department of CICC

Chart: Guangdong bidding price difference

Source: Electric Power Trading Center; Research department of CICC

Note: The bid price difference in August 2020 is 130 yuan/MWh.

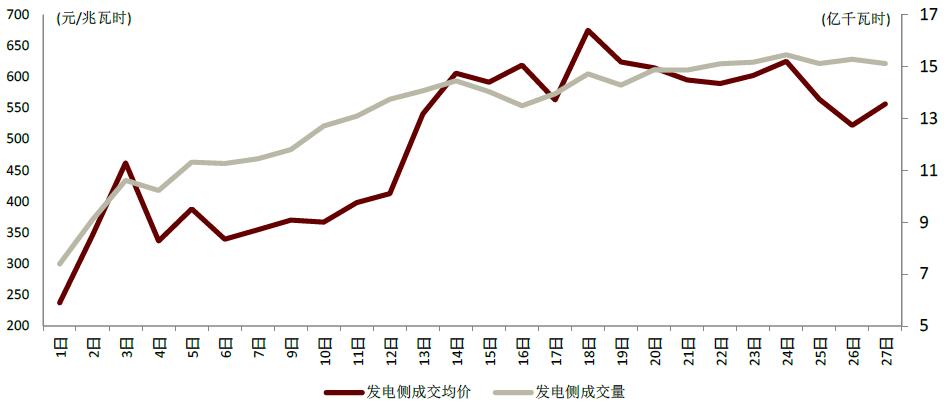

The spot transaction price in Guangdong far exceeds the benchmark, and it is difficult to improve in a long period of time. The tightness of supply and demand in the electricity spot market is obviously reflected in the spot transaction price. In May, the daily average transaction price of Guangdong electric power spot settlement continued to rise, exceeding the benchmark price of 463 yuan/mwh on May 13, reaching 541 yuan/mwh; Then the price continued to rise, reaching the peak of 675 yuan/MWh on May 18th. After that, the price declined to some extent, but it remained above 500 yuan/MWh. The high transaction price in the spot market reflects that the cost pressure of power generation enterprises is partly transmitted to the downstream, and it has entered the peak period of power consumption in summer. We expect that the situation of high spot transaction price is difficult to change and will continue for a long time.

Chart: Average daily transaction price and volume of spot settlement of electricity in Guangdong in May 2021 (right)

?

?

Source: Power Trading Center, Research Department of CICC.

Linking energy consumption index with green electricity to promote the distributed development of industry and commerce

The high-carbon emission industry may not be able to expand its production due to the lack of energy consumption indicators, and instead build its own distributed power station and use green power for its own use. Under the constraint of energy consumption index, we think that some enterprises with high carbon emissions will obviously increase their demand for green electricity in order to obtain the new capacity quota index. Industrial and commercial enterprises may install their own distributed power stations, and use low-cost green power sources such as wind power and photovoltaic for their own use. When the policy allows, they can also use surplus electricity to access the Internet, which will increase the flexibility of electricity use and avoid the problem of power restriction.

At present, many enterprises have made relevant attempts, and the 800KW distributed photovoltaic power generation project of Ji ‘an Wood Industry has been put into operation. Sinopec plans to lay out 7,000 distributed photovoltaic power stations in the 14th Five-Year Plan. With the further development of energy consumption indicators, the distribution of industry and commerce may develop rapidly in the future.

Perfecting the energy storage price mechanism in the 14 th Five-Year Plan is imminent

Promote the low-carbon transformation of energy supply structure and implement the newly introduced pumped storage price mechanism. Pumped storage power station has many functions, such as peak regulation, frequency modulation, voltage regulation, system standby and black start, etc. Compared with thermal power and electrochemical energy storage, it has higher flexibility, cost advantage and environmental protection advantage. In the future, a two-part electricity price policy will be adopted to form electricity price in a competitive way, and the demand for energy storage will be determined by the market, which will ensure the return and stability of the project (the return standard is 6.5%), help to enhance investment attraction, introduce social capital to participate in pumping and storage investment, and be fair and open to the power grid. At present, the installed capacity of pumped storage is 31.79 million kilowatts, and 54.63 million kilowatts are under construction. According to the plan of the National Energy Administration, the demand for pumped storage will reach 140-160 million kilowatts in 2035, and the "Tenth Five-Year Plan" is expected to become the golden stage of pumped storage development.

For the first time, the "independent market dominant position" of new energy storage is given, and the solution idea of "who pays for energy storage" is given. According to the "Guiding Opinions on Accelerating the Development of New Energy Storage (Draft for Comment)" issued by the National Development and Reform Commission and the National Energy Administration, by 2025, the goal is to realize the transformation of new energy storage from the initial stage of commercialization to large-scale development, with an installed capacity of more than 30 million kilowatts. By 2030, the new energy storage will be fully market-oriented. The Opinions are expected to bring about three changes: 1) Energy storage on the power supply side: new energy+energy storage can be given priority in terms of project competitive configuration, approval and filing, grid-connected timing, system scheduling and operation arrangement, guaranteed utilization hours, compensation assessment of power auxiliary services, etc., or help to improve economic pressure; 2) Grid-side energy storage: the income from independent energy storage may come from capacity price+gradual participation in the power market, among which the cost of facilities belonging to "grid alternative energy storage" may be included in the recovery of transmission and distribution price in the future; 3) User-side energy storage: the benefits and costs of energy storage mainly depend on the arbitrage of peak-valley electricity prices, and more development space is created by improving the peak-valley electricity price policy.

We will improve green electricity price policies such as differential electricity price and ladder electricity price for industries with high energy consumption and high emissions, increase implementation, and promote energy conservation and carbon reduction. In order to promote the transformation and upgrading of industries with high energy consumption and high emissions, in addition to setting emission reduction targets, provinces have imposed punitive measures on enterprises that fail to meet the targets to promote self-innovation and elimination within the industry.

In Jiangsu, iron and steel enterprises that have not completed the transformation according to the requirements of ultra-low emission transformation and failed to meet the standards after the transformation have implemented the measures of increasing the electricity price by stages and layers on the basis of the current electricity price or the market electricity price.

Inner Mongolia continues to implement the step price policy for electrolytic aluminum, cement and steel industries, and the differential price policy for electrolytic aluminum, ferroalloy, calcium carbide, caustic soda, cement, steel, yellow phosphorus and zinc smelting.

Gansu requires power companies to submit the implementation and collection of differential electricity prices in the previous year in January each year.

If you like this article, you can see more stocks, disk trend analysis and investment skills on Moore Financial APP or moer.cn, the official website of Moore Financial, and you can also search for Moore Financial on Sina Weibo, WeChat WeChat official account and today’s headlines and pay attention to it.