Children’s Day is approaching. In shopping malls, supermarkets and major e-commerce platforms, children’s products have become the hottest promotion keywords, and children’s foods are more diverse and dizzying. Some parents often feel confused when shopping. How to buy nutritious snacks for their children during the critical period of their physical growth and prevent them from buying junk food and fake and shoddy food has become the most concerned issue for parents. The reporter recently conducted an in-depth visit to the children’s snack market with many problems reflected in readers’ letters and formed an investigation report.

The children’s snack market has great potential.

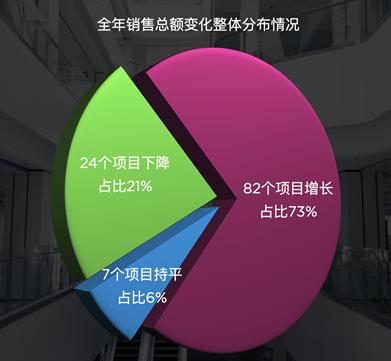

Snacks play an increasingly prominent role in the daily diet of children and adolescents in China and have become an important dietary component. At the end of 2019, the number of children under 16 in China was 249.77 million, accounting for 17.8% of the total population. The huge population of children means huge potential market demand, and the children’s snack market is rising rapidly. It is estimated that the children’s snack market will grow steadily at a compound annual growth rate of 10% to 15% from 2019 to 2023.

On May 17th, the White Paper on Market Investigation of Children’s Snacks (hereinafter referred to as the White Paper) jointly formulated by China Non-staple Food Distribution Association, Institute of Food and Nutrition Development of Ministry of Agriculture and Rural Affairs was officially released. The White Paper pointed out that the problems of nonstandard labeling of children’s food, worrying nutritional value of children’s snacks and low trust of parents in domestic children’s food brands have restricted the healthy development of children’s snack market.

Some children’s foods are added with various additives to increase the taste; Some snacks use the concept of "children", but the ingredients are actually no different from those of ordinary food; Some foods claim to be suitable for people, but the ingredients are not in line with reality.

Experts say that the quality of children’s snacks will affect children’s nutritional status to a certain extent, and children’s immunity and physical function can’t be compared with adults. Healthy children’s snacks suitable for children’s nutritional needs will be more conducive to the healthy development of children’s bodies. However, in the current children’s snack market, the product quality is mixed, including high-end snacks specially developed for children, unhealthy snacks with high sodium and fat, and even "spicy" snacks with no products. In terms of snacks, most of them are candy, biscuits, puffed snacks and other popular snacks, which are not obviously different from adult snacks, and the product definition is vague.

Children’s soy sauce, children’s biscuits, children’s milk, children’s milk drinks and other foods labeled as "children" flooded major stores and supermarkets and were favored by young parents. In fact, there is no difference in ingredients between children’s food and ordinary food, but the price is more expensive than ordinary food. At present, some children’s foods on the market only have the name of "children" but are not "special", but are only market means to subdivide products. Some businesses take advantage of parents’ neglect of children’s food nutrition labels, seize its loopholes, exaggerate in propaganda and mislead consumers. Therefore, parents must carefully screen when purchasing children’s food, and don’t fall into the trap of merchants.

This year’s "children’s food"

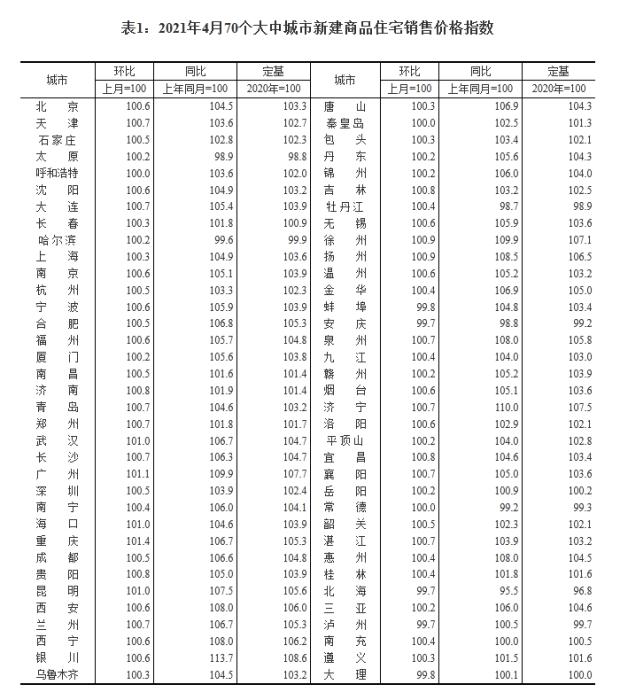

Plan to sample 3522 batches.

In 2020, the Market Supervision Committee plans to carry out sampling inspection and monitoring of "children’s food", and plans to carry out a total of 3,522 batches, including 353 batches of dairy products, 928 batches of beverages, 270 batches of biscuits, 278 batches of frozen drinks, 426 batches of potatoes and puffed food, 622 batches of candy products and 645 batches of fruit products.

Health tips

Establish a balanced diet

Rational nutrition concept

How should we guide children and adolescents to establish the concept of balanced diet and reasonable nutrition from an early age, and reduce or correct bad snack consumption behavior? In 2018, the Institute of Nutrition and Health of China Center for Disease Control and Prevention and the Nutrition Society of China jointly compiled the Snack Guide for Children and Adolescents in China 2018. "In recent years, the dietary nutrition status of children and adolescents in China has been greatly improved, but there are also problems such as excessive snack consumption and lack of scientific guidance." Zhang Bing, deputy director of the Institute of Nutrition and Health, China Center for Disease Control and Prevention, said. The consumption rate of snacks among people aged 2 and over in China has increased from 11.2% in the 1990s to 56.7% recently, and snacks provide about 10% of the total daily energy. Children and adolescents are in a critical period of growth and development, and it is also an important stage to develop good eating habits. Excessive or unreasonable snack consumption behavior may increase the risk of obesity and related chronic diseases.

The Guide is divided into three volumes according to age groups, which are applicable to 2— 5-year-old preschool children, 6-mdash; 12-year-old school-age children and 13-mdash; 17-year-old teenagers.

2— 5-year-old preschool is the key stage of children’s growth and development. At this stage, three rich meals and two moderate meals are the guarantee for preschool children to get comprehensive nutrition. If you need to add snacks, you should add a small amount and choose healthy snacks. Therefore, for 2— The core recommendations of 5-year-old preschool children include: 1. Eat a good dinner, add a proper amount of meals and a small amount of snacks; 2. Snacks are preferably fruits, milk and nuts; 3. Eat less snacks with high salt, sugar and fat; 4. Do not drink or drink less sugary drinks; 5. Snacks should be fresh, diverse, digestible, nutritious and hygienic; 6. Eat snacks quietly and beware of choking; 7. Keep your mouth clean and don’t eat snacks before going to bed.

6— The dietary pattern of 12-year-old school-age children has gradually changed from three meals and two meals in preschool to three meals a day, and the food intake for dinner has increased. However, due to the long interval between meals, it is easy to feel hungry, and because of the continuation of preschool eating habits, it is easy to produce snack consumption demand. Therefore, for 6— The core recommendations of 12-year-old school-age children include: 1. Main meals, reasonable breakfast and small snacks; 2. Appropriate meals between classes, preferably fruits, milk and nuts; 3. Eat less snacks with high salt, sugar and fat; 4. Do not drink or drink less sugary drinks, and do not drink alcoholic and caffeinated drinks; 5. Snacks are fresh, nutritious and hygienic; 6. Keep your mouth clean and don’t eat snacks before going to bed.

13— 17-year-old teenagers are experiencing the second peak of growth and development-puberty development stage. Teenagers in this period need a lot of energy and nutrients, and they are more autonomous and independent in food choice, which is easy to produce impulsive food consumption and even rely on some snacks. Therefore, for 13— The core recommendations of 17-year-olds include: 1. Eat three meals well and avoid snack substitution; 2. Learn nutrition knowledge, reasonably choose snacks, preferably fruits, milk and nuts; 3. Eat less high-salt, high-sugar, high-fat and smoked fried snacks; 4. Do not drink or drink less sugary drinks, and do not drink alcohol; 5. Snacks are fresh, nutritious and hygienic; 6. Keep your mouth clean and don’t eat snacks before going to bed.

Authoritative voice

The market supervision Committee will focus on the supervision of children’s food.

Whether children’s food is safe or not is related to children’s physical and mental health, and parents are particularly concerned. It is in view of this special nature that the market supervision department, in accordance with the provisions of the Interim Measures for the Risk Classification Management of Food Business in Tianjin, takes food operators such as small supermarkets, grocery stores and food mobile vendors around the campus, the urban-rural junction and the rural food market as the key targets of daily supervision, and conducts special law enforcement inspections on snacks such as fried noodles, puffed food, bean products, candy and fruity drinks. In accordance with the deployment requirements of the General Administration of Markets, special rectification actions were carried out on solid drinks, pressed candy, substitute tea and other foods.

According to the relevant person in charge of the Market Supervision Committee, in the ongoing special supervision and inspection of school food safety in the spring, food operators around the campus have been listed as special inspection targets. On the basis of daily supervision and inspection, full coverage supervision and inspection will be further carried out to increase the supervision and inspection of children’s food, focusing on cracking down on illegal activities such as selling fake and shoddy food, expired food, and "two super foods and one non-food". In the daily supervision and inspection, we also require food operators to post the record form of daily supervision and inspection results filled out by the market supervision department in a prominent position in the business premises for publicity, so as to facilitate consumers to understand food safety-related information.

In the daily supervision, the market supervision department focuses on the inspection of food sales units such as small supermarkets, grocery stores, food vendors, maternal and child stores, pharmacies, hospitals, etc. on campus and surrounding areas to check whether their main qualifications are legal; Check whether the food manufacturer, production date, shelf life, food production license and food label are legal and compliant; Whether there are expired and deteriorated foods, fake and shoddy foods, and whether the food sold has complete procedures and legal sources can be obtained by checking the ticket.

Food operators around the campus are rated as the highest risk level.

The Market Supervision Committee will further strengthen the supervision of children’s food, strengthen the supervision of food quality and safety, and ensure the health of children.

The person in charge said that when revising the Interim Measures for the Risk Classification Management of Food Business in Tianjin, the food operators around the campus will be designated as the highest risk level D, the frequency of supervision and inspection will be increased, and the food safety supervision around the campus will be effectively strengthened. At the same time, further strengthen the implementation of the main responsibility of food operators, and strictly publicize the responsibility of information such as daily supervision and inspection results, so that parents can know the food safety status of food operators in time. "We will also cooperate with the education department to carry out food safety on campus and compile food safety knowledge books for primary and secondary schools to increase children’s food safety knowledge and raise their awareness of self-protection."

When parents and children buy children’s food, first, they should pay attention to checking the business qualifications of the merchants and see if the sellers have obtained the relevant license certificates for operating such foods; Whether the stated business items are consistent with the products actually sold. The second is to ask for purchase vouchers to ensure the legitimacy and traceability of the purchased food sources. The third is to understand the difference between ordinary food, infant formula food and special medical food, and to prevent illegal business practices such as false propaganda of stores. The fourth is to check whether the label identification is standardized, and whether the production date and shelf life of the food labels sold are significant and easy to identify, and whether they comply with laws and regulations.

Law enforcement forces focus on investigating and handling illegal activities in children’s food production and operation.

The relevant person in charge of the Tianjin Municipal Market Supervision Comprehensive Administrative Law Enforcement Corps said that in order to effectively protect the food safety of the people in our city, combined with the actual food safety supervision in our city, the Market Committee formulated the "Tianjin Municipal Market Supervision and Management Committee’s Implementation Plan for Strengthening the Investigation and Handling of Food Cases in 2020".

Illegal activities in food production and operation such as "black factories", "black workshops" and "black dens"; Illegal activities in the production and operation of campus food safety; Illegal activities in the production and operation of food for infants and children have been included in this year’s key investigation targets.

Focus on investigating and handling cases of food safety violations that occurred in and around the campus, catering gathering areas, farmers’ wholesale markets, rural and urban-rural junctions, food and non-staple food wholesale markets, cold storage centers, off-campus training institutions and other places.

Law enforcement departments will continue to intensify law enforcement supervision and inspection of food shops and small stalls on campus and its surrounding areas, further standardize the business behavior of operators, and focus on the management of food business by mobile vendors on campus and its surrounding areas. At the same time, increase the frequency of food sampling inspection, find out the problem products in time, establish and improve the long-term supervision mechanism of food safety, focus on solving the outstanding problems in the field of food safety, effectively enhance the people’s sense of acquisition, happiness and security, and ensure "safety on the tip of the tongue".

Expert advice

Snacks that simply pursue taste are not recommended.

On the issue of children’s snacks, the reporter also interviewed Professor Yu Jinghua from the College of Food Science and Engineering of Tianjin University of Science and Technology. He introduced that children’s snacks in the market are mainly divided into three categories: the first category is snacks produced according to the needs of children’s nutrition. Although there are no relevant standards and norms for children’s snacks in China, nutrition has recommended amounts of various nutrients needed by children at all ages. Therefore, this kind of children’s snacks is to produce snacks suitable for children according to the guidance of nutrition. The second category is actually just ordinary snacks, and the ingredients are no different from those of adults. However, in order to point the marketing target at children, it is designed to look like children’s favorite in the outer packaging or eating methods. At present, there are no standards and norms for children’s snacks in China, so this kind of snacks does not meet the requirements of children in terms of nutrition itself. The third kind of snacks is completely for attracting people’s attention, attracting children and parents, and adding some functional ingredients that are beneficial to children symbolically. There is no basis for designing and manufacturing snacks in nutrition, and it is purely for sales.

Many parents smell "additives", but nowadays there are almost no snacks without additives. In the interview, the reporter found that many parents favor the so-called homemade snacks, in fact, it is largely because the seller said that there are no additives. In this regard, Professor Yu Jinghua said that most of the additives in snacks are required by the process. If added according to laws and regulations, it will not harm people’s health. For example, jelly must be added to solidify fruits and juices. Colloid is also an additive. If not added, this jelly will not become jelly, so additives are not all bad. However, blindly pursuing the flavor and taste brought by an additive is only to make snacks taste better. If children eat them for a long time, it will inevitably stimulate the taste buds too much, thus affecting the taste recognition of children as adults.

In recent years, some home-made foods have become very popular on the Internet. However, Professor Yu Jinghua reminded parents that home-made food has no product standards, no safety inspection, and no elements of food circulation, so it is difficult to guarantee safety. The so-called preservative-free, food is easy to deteriorate without preservatives, how can we ensure that food does not deteriorate during online shopping and logistics transportation? If you cook and eat now, you may have a very good taste and nutrition. However, if you sell it online, after a few days of logistics arrival, the taste and organizational status will become worse, especially the microbial indicators cannot be guaranteed. How dare you give it to children?

Many parents think that children should eat more vegetables and fruits, and there is no need to eat snacks. Professor Yu Jinghua said that in fact, snacks should be supplemented with nutrition in essence, such as protein, vitamins, trace elements, energy, etc. If these functions can be achieved, it is still necessary for children to eat some properly. However, if it is purely for the taste and to meet the needs of taste buds, such as snacks with strong flavor and high sugar content, it is really unnecessary to give them to children.

He suggested that parents should buy snacks for their children, or should go to supermarkets or shopping malls to buy regular brands of goods, with complete packaging and clear nutrition labels, so that parents can identify and distinguish purchases; Once there is a quality problem, the traceability channel is smooth and the rights and interests are guaranteed. Some parents go to the market to buy bulk food for their children, whose composition is unknown and the source is unknown; In addition, food is often aired outside, and the hygienic condition of exposure to the air is not guaranteed. The microbial index of food is easy to exceed the standard, so it should be purchased with caution.

Typical problem

Online shopping for homemade food is mostly "three noes"

Duoduo (pseudonym) is two years old this year. Since she was one year old, she could eat a lot of complementary food. Her mother began to buy her homemade yogurt, dissolved beans, fruit crisp and other foods online. Her mother saw a "Erwa Mom" researching and making complementary food on the Tik Tok. She felt that there were no additives, and they were all made of natural ingredients, which was good for children’s health, so she started online shopping. The reporter saw in Duoduoma that this kind of self-made complementary food has only a simple outer packaging, no ingredient list, no production date and shelf life, and no food safety certification. The price is more expensive than that of similar products of regular brands, such as yogurt and dissolved beans. The price of the same product in the market is around 20 yuan, but a small bag bought online by Duoduoma is 25 yuan. "After all, people are the mothers of two children, and they have experience with their babies, so they trust her more." Duo Duo Ma said.

Tu Tu (a pseudonym) is three years old and doesn’t like drinking water. His mother listened to a friend’s introduction and joined a group built by Wechat business’s mother. This mother specializes in selling homemade autumn pear cream, saying that it is completely handmade, without any additives and preservatives. As long as a teaspoon is given to the child at a time, it can moisten the lungs and relieve cough. A small bottle of 150 grams, priced at 149 yuan, also has no ingredient list, no production date and shelf life, and no food safety certification. In the supermarket, a bottle of 290 grams of brand autumn pear cream for children is only 10 yuan. "I was a little worried about food safety at first, but I thought that so many parents in the group were rushing to buy her autumn pear cream, and it was still limited. I thought it should be right, so I bought it boldly." Tu Tu’s mother said.

There is no yogurt in "dry yogurt"

On May 28, the reporter saw in a convenience store in the urban-rural fringe that a small candy called "dry yogurt" on the counter was very popular with children, and the price was cheap, 10 pieces for one yuan. During this period, two teenagers bought 80 tablets at 8 yuan. The reporter saw that on this candy package, the word "dry yogurt" was very eye-catching, and the font height accounted for one-third of the packaging height. It is also marked in English: Pure milk candy, which means pure milk candy. Looking at the ingredients list on the back, I found that the ingredients of this candy are glucose syrup, white sugar, cocoa butter substitute, edible spices, etc., but there is no ingredient of yogurt or milk. One of the inconspicuous words reads the name: yogurt-flavored sugar, which means that this so-called "dry yogurt" candy has nothing to do with yogurt and milk. Such labeling of product packaging is tantamount to deceiving consumers. If you don’t look carefully, you can’t judge at all.

Multicolored chocolate beans have three products.

At a booth selling homemade cakes, the reporter saw that there were some children’s snacks besides cakes, among which a transparent plastic bottle filled with colorful chocolate beans was placed in a conspicuous place. The reporter picked it up and found that there was no production date, manufacturer, food license number or even name on the bottle. The reporter asked quickly, "Did you do this?" The merchant replied, "How can we have this ability? This is the goods from the wholesale market, which can be sold well." Just then, a little girl bought this product.

Milk-containing drinks promote the edge ball

Ms. Lei, a citizen, said that her children don’t like to drink milk, but they like to drink milk-containing drinks. Every time they are not allowed to drink, the children are eloquent. This is also a kind of milk, and it tastes sweet.

Judging from the reporters’ on-the-spot visits, including the large-scale brand supermarket chains, the salespeople of dairy products are mostly vague about the specific differences of dairy products. Some directly write children’s yogurt or milk, but some signs are added at the back to inform that other ingredients are added. The reporter saw in a supermarket on the middle road around the lake that the words "children’s yogurt" were written on the shelf, and the place of origin was "Thailand". After the reporter bought it, he looked at the ingredients list at the back and found that yogurt accounted for 52% (milk, reconstituted milk, lactic acid bacteria), and the rest were 10 kinds of additives such as white sugar, pectin and sunset yellow. The name on the package is also vague, and it says "orange yogurt drink".

The reporter learned that some parents will prepare some dairy drinks for their children in order to make up for their children’s lack of drinking milk in the morning. Although dairy drinks will have a certain proportion of milk as raw material, it will add some auxiliary materials such as sucrose, concentrated juice and essence. After treatment, although it is very suitable for children’s tastes, its nutritional value is greatly reduced.

A packet of spicy strips contains 15 kinds of additives.

At 18: 30 on May 28th, the reporter randomly bought 9 kinds of snacks in the vegetable market and shopping mall near huaming town in Dongli District. After careful observation, it was found that two of them had no production date, while some sweets were simply packed in plastic bags or glass bottles, and the packaging was easily damaged without sealing. There is not even a basic product name on the outer packaging.

Some snack packaging names are very deceptive, which seem to be similar to the packaging of well-known biscuit brands, but they are two completely different things. Some chocolate beans are also packed in bottles similar to well-known drinks, which is confusing.

In terms of ingredients, it is even more surprising: a bag of spicy strips named "Xiangbalao" has the words "seasoning noodle products" clearly written on the product type, and the net content is "28 grams", which is accurately divided into "ingredients" and "food additives". "Ingredients" include seven ingredients such as wheat flour, natural spices and edible salt, while "food additives" column includes 15 kinds of food additives such as sodium glutamate, sodium cyclamate, chicken powder, sodium stearoyl lactate and disodium dihydrogen pyrophosphate. A pack of dried adzuki beans contains as many as seven or eight kinds of additives.

Although these terms are very detailed and seemingly professional, parents are inevitably worried. Ms. Wang said: "There are too many additives. What is it? What effect will children have if they eat it? "