Jing Zheng Fa [2022] No.17

District People’s governments, municipal government commissions, offices and bureaus, and municipal institutions:

The traffic development and construction plan of Beijing during the 14th Five-Year Plan period is hereby printed and distributed to you, please earnestly implement it.

the people’s government of beijing city

April 10, 2022

Traffic Development and Construction Planning in Beijing during the Tenth Five-Year Plan Period

foreword

The "Fourteenth Five-Year Plan" period is the first five years after China has built a well-off society in an all-round way and achieved the first century-long struggle goal, taking advantage of the situation to start a new journey of building a socialist modern country in an all-round way and March towards the second century-long struggle goal. The development of transportation will shift to pay more attention to quality and efficiency, to pay more attention to the integration and development of various modes of transportation, and to pay more attention to innovation. Beijing Traffic Development and Construction Plan during the Tenth Five-Year Plan is the first five-year plan to fully implement the Outline of Building a Traffic Power. In the next five years, a new round of technological revolution will bring about profound changes in the industry. The layout of the national system will be "new infrastructure", and Beijing will build a global digital economy benchmark city, which will accelerate the digital transformation and intelligent upgrading of transportation and build a comprehensive, green, safe and intelligent three-dimensional modern urban transportation system.

This plan is formulated in accordance with the Outline of Beijing-Tianjin-Hebei Coordinated Development Plan, Beijing Urban Master Plan (2016 -2035), Outline of Building a Powerful Transportation Country, Outline of National Comprehensive Three-dimensional Transportation Network Planning, Development Plan of Modern Comprehensive Transportation System in the Tenth Five-Year Plan and Outline of Beijing’s National Economic and Social Development and Long-term Goals in 2035, etc., and defines Beijing during the Tenth Five-Year Plan period.

First, the foundation of development

The "Thirteenth Five-Year Plan" period is an important milestone in the history of Beijing’s development, and the development of Beijing’s transportation industry has achieved remarkable results. The 1-hour traffic circle in the core area of Beijing-Tianjin-Hebei and the 1.5-hour traffic circle between neighboring cities have basically taken shape. The proportion of green trips in the central city has increased to 73.1%, and the average road traffic index in peak hours has decreased to 5.48 (data in 2019). The concept of "slow travel priority, bus priority and green priority" has been deeply rooted in the hearts of the people, and the road traffic congestion situation has been effectively controlled. In order to implement the coordinated development strategy of Beijing-Tianjin-Hebei, implement the strategic positioning of the capital city and strengthen the "four centers

(A) Beijing-Tianjin-Hebei traffic integration to a new level

1. The formation of aviation "double hub" pattern.

At the end of September 2019, Beijing Daxing International Airport was officially put into operation, becoming a new power source for national development and a new country facing the world. The function of international communication service was significantly improved. The "five vertical and two horizontal" peripheral comprehensive transportation system was implemented simultaneously, and the coordinated development of Beijing-Tianjin-Hebei achieved remarkable results. The route network structure and comprehensive transportation system of Beijing Capital International Airport have been continuously improved. The aviation "double hub" pattern has initially taken shape, with the annual passenger throughput exceeding 100 million passengers.

2. Building "Beijing-Tianjin-Hebei on the Track"

The Beijing-Xiongan Intercity Railway has been completed and opened to traffic, and it takes 50 minutes for Beijing to reach xiong’an new area quickly. The Beijing-Zhangjia high-speed railway opened for operation, increasing the high-speed rail passage from Beijing to the northwest. The construction of the first phase of the intercity railway connection line has been accelerated, and the construction of Beijing-Hong Kong-Taiwan high-speed railway, Beijing-Harbin high-speed railway, Beijing-Tangshan intercity railway and Jingbin intercity railway has been accelerated in an all-round way, and the regional intercity railway network is accelerating. By the end of the Thirteenth Five-Year Plan period, the construction of seven national trunk railways planned within the Beijing-Tianjin-Hebei area has been continuously promoted, and a national railway network with Beijing and Tianjin as the core hubs has basically taken shape. The total mileage of railway operation in Beijing reached 1,351 kilometers, which was 71.1% of the 2035 target (1,900 kilometers) of the overall urban planning.

3. Promote the construction of comprehensive transportation hub.

The Beijing-Zhangjiakou high-speed railway will be built to support railway hubs such as Qinghe Railway Station and Beijing Chaoyang Station, and the reconstruction project of Beijing North Railway Station will be completed, and the reconstruction project of Beijing City Sub-center Station and Beijing Fengtai Station will be started. All the eight national passenger transport hubs planned in Beijing have entered the accelerated completion period, which strongly supports the connection and integration of the multi-level railway network of "Beijing-Tianjin-Hebei on the track". Road-ground linkage, comprehensive policy, complete the comprehensive traffic management tasks of Beijing South Railway Station, Beijing West Railway Station and Beijing Railway Station, and continuously improve the connection traffic support capacity and service quality.

4. Road network accessibility has been further improved.

The "dead end road" of the national expressway network in Beijing has been cleared, and the supporting roads of the Winter Olympics and Paralympic Winter Games, the World Expo Security Project and Beijing Daxing International Airport have been completed and opened to traffic. During the "Thirteenth Five-Year Plan" period, the expressway added 191 kilometers with a total mileage of 1,173 kilometers. Vigorously promote the construction of ordinary national highways, and the regional road network has been continuously improved. The total mileage of highways in the city has reached 22,264 kilometers, an increase of 379 kilometers compared with the end of the Twelfth Five-Year Plan, and 96.2% of the overall urban planning target of 23,150 kilometers has been achieved, and the proportion of ordinary national highways above the second-class road has reached 89.4%. Complete the planning and construction of comprehensive checkpoints and the top-level design of operation and maintenance management, and build Yanchong Station of Jingli Expressway to achieve a new breakthrough in building stations in different places.

5. Promote the integration of transportation services in Beijing, Tianjin and Hebei.

The integration of people flow, logistics and information flow was accelerated. 38 inter-provincial bus lines have achieved normal operation, with a total mileage of 2,700 kilometers and an average daily passenger traffic of more than 200,000 passengers. Accelerate the bus transformation of road passenger lines in adjacent areas between provinces, and complete the bus transformation of five passenger lines from Pinggu to Zunhua, Baodi and Jixian. "Inter-provincial bus transformation" has become the norm and cross-regional travel is more convenient. Promote cross-regional (city) and cross-mode communication of traffic cards, and issue more than 7 million Beijing traffic interconnection cards to realize interconnection with 288 cities across the country. Realize the navigation of the Beijing-Hangzhou Grand Canal (Tongzhou city section). Relying on the Beijing-Tianjin-Hebei comprehensive transportation corridor, some regional express distribution centers will be moved out, and the cross-regional logistics system will be more perfect. Promote legislative coordination in the transportation field of Beijing, Tianjin and Hebei.

(B) "four centers" to enhance the ability to support

1. Continuously optimize the traffic travel structure.

By the end of the "Thirteenth Five-Year Plan", the proportion of green travel in downtown Beijing reached 73.1%, an increase of 2.4 percentage points compared with the end of the "Twelfth Five-Year Plan", further narrowing the gap with the 2035 target of the overall urban planning (80%).

The coverage of rail transit network has been expanded, and the service quality has been comprehensively improved. During the "Thirteenth Five-Year Plan" period, rail transit lines (sections) such as Line 8 (Phase III and Phase IV), Line 6 Xiyan and Daxing Airport Line were opened to traffic, with an additional operating mileage of 172.9 kilometers, reaching 727 kilometers, and the highest passenger traffic on weekdays exceeded 13.77 million, ranking first in the country. The number of suburban railway lines has increased to four, and the operating mileage in the city has reached 364.7 kilometers. By the end of the 13th Five-Year Plan period, the total mileage of rail transit (including suburban railways) reached 1,091.7 kilometers. The operation organization of rail transit continued to be optimized. The departure interval of 10 lines was less than 2 minutes, and the reliability of train service reached 30,511,100 vehicle kilometers/trip, which was nearly 7 times higher than that at the end of the Twelfth Five-Year Plan. Timely take extraordinary and super-strong network operation measures to effectively protect the travel needs of citizens. Realize the full coverage of the city’s rail "one code pass" and mobile payment, and release the timetable of rail trains, making passengers travel more convenient. In 2020, the KPI of the International Metro Association (COMET) ranked first in Beijing Metro.

Efforts have been made to optimize public transport services and the service level has been continuously improved. The construction of bus lanes such as the Third Ring Road, Beijing-Tibet Expressway, Beijing-Hong Kong-Macao Expressway and Chengfu Road was completed, and the mileage of new bus lanes was 579.6 lane kilometers, with a total mileage of 1,005 lane kilometers, which was 67% of the overall urban planning target of 1,500 lane kilometers in 2035. Bus lanes were basically networked, and bus rights were further guaranteed. Release the Master Plan of Beijing Ground Bus Network and continuously optimize the ground bus lines to achieve 24-hour bus coverage within the Third Ring Road. Enrich diversified bus service modes, and add 135 diversified bus lines, such as customized bus lines, tourist buses, high-speed rail express buses (Beijing South Railway Station) and hospital dedicated lines, totaling 455. By the end of the Thirteenth Five-Year Plan period, the coverage rate of ground bus stops in the built-up area of the central city reached 100%, and the density of bus network reached 3.35km/km2. Tiantongyuan North Comprehensive Transportation Hub was put into operation, the main supporting transportation hub of Qinghe Station was completed, the transportation hub of Wangjing West was started, and the transfer efficiency of urban public transportation was improved. Realize the full coverage of Beijing Traffic APP to inquire about the real-time bus arrival information lines, promote the payment of bus two-dimensional code, realize "one code communication and interconnection", and continuously improve the passenger travel experience, so that passengers can travel in a planned and predictable way. The construction of "transit metropolis" passed the acceptance test and won the title of "National transit metropolis Construction Demonstration City".

Walking and cycling have returned to the city, and the environment for slow travel has improved significantly. More than ten plans, standards and specifications have been compiled, the Technical Guide for Improving Pedestrian and Bicycle Traffic Facilities has been revised, and the Standard for Planning and Design of Pedestrian and Bicycle Traffic Environment has been issued to promote the standardization and standardization of the industry. The first bicycle commuter road in China has been built, with a total length of 6.5 kilometers and an average daily traffic volume of over 4,000 vehicles, effectively improving the efficiency of commuting from Huilongguan to Shangdi. Implement the action of improving the quality of the slow-moving system, complete the governance of the slow-moving system in the secondary trunk road and above 3218 kilometers in the central city, and gradually connect the slow-moving systems into a network. Complete the construction of 9 slow-moving system demonstration blocks, such as Northwest CBD and Huilongguan, and promote the overall improvement of the city’s slow-moving traffic environment from point to area.

2. Continue to alleviate traffic congestion

The road congestion in the central city gradually eased, and the road traffic index continued to decline. At the end of the Thirteenth Five-Year Plan, the road traffic index was 5.48 (data in 2019), which was 3.9% lower than the 5.7 at the end of the Twelfth Five-Year Plan.

Continue to promote the construction of urban road network. Urban expressways and trunk roads such as Guangqu Road Phase II and Dongyan, Chang ‘an Street West Extension, Yunhe East Street, Lincui Road, Majiapu West Road South Extension, Jinzhongdu South Road and Xisanqi South Road have been built, and 197 sub-branches have been built, with a total mileage of urban roads reaching 6,147 kilometers, a decrease of 276 kilometers compared with the end of the Twelfth Five-Year Plan (affected by the development and demolition of the area), of which expressways are 390 kilometers (compared with the Twelfth Five-Year Plan)

Take multiple measures to control car ownership and car use. We will implement the policy of regulating and controlling passenger car indicators, formulate an indicator allocation plan for "car-free families", and issue 20,000 new energy passenger car indicators for car-free families in 2020. By the end of the Thirteenth Five-Year Plan period, the number of motor vehicles in the city was 6,569,500 (including 5,273,000 passenger cars), which effectively controlled the excessive and disorderly growth of passenger cars. Formulate and implement traffic management measures for high-emission trucks, reduce the number of trucks entering Beijing from other places by 26%, and ban diesel trucks with national emission standards throughout the city. We will strengthen the management of foreign buses’ passes to Beijing, limit the number of applications and the effective time, and reduce the number of foreign buses used in Beijing for a long time by 56%. We will continue to intensify efforts to crack down on illegal activities such as renting and selling passenger cars, illegally modifying light trucks and breaking the ban.

3. Smart transportation helps facilitate travel

The integrated travel service was accelerated. Take the lead in introducing the open management method of traffic travel data in China, deepen the application of big data in urban traffic governance, and promote the deep integration of transportation industry and Internet enterprises. Vigorously develop shared transportation, build a service system based on mobile intelligent terminal technology, realize "travel as a service", and launch the first green travel integrated service (MaaS) platform in China, covering more than 95% of the city’s bus lines, with the accuracy of real-time information matching exceeding 97% and the cumulative number of users reaching more than 24 million, providing high-quality and refined services for citizens to reasonably choose travel time, travel mode and travel route. Beijing’s public transportation has achieved "one-code ride", with more than 9.2 million registered users, and the proportion of cross-mode code brushing exceeds 20%, making public transportation transfer more convenient.

Scientific and technological innovation has yielded fruitful results. Promote the construction of Yanchong’s "smart expressway" and take the lead in carrying out vehicle-road collaborative testing under the closed expressway scene in China. China’s first 40-square-kilometer autonomous driving test area was opened, with 200 test roads of 700 kilometers. A total of 87 autonomous vehicles obtained test licenses, with a test mileage of over 2 million kilometers, and the development level of autonomous driving is leading the country. The Capital Airport Line of Rail Transit is the first in China to try a subway communication transmission platform based on EUHT-5G (ultra-high-speed wireless communication technology), which comprehensively carries a variety of services such as train control system, video surveillance system, passenger information system, train broadcast, etc., and provides passengers with a diversified ride experience. Opening the first fully-automatic rail transit Yanfang Line with completely independent intellectual property rights in China. Beijing Daxing International Airport Instrument Landing System (ILS) Class Ⅲ B low visibility operation guarantee, all-weather advanced ground activity and control system (A-SMGCS) four-level lighting guidance, and the use of HUD to implement runway visual range (RVR)75-meter takeoff capability have all reached the world leading level.

4. The effect of energy structure adjustment is beginning to appear.

Optimize the energy structure of vehicles, and eliminate 69,000 diesel trucks. The proportion of clean energy and new energy in public transport vehicles is 90.2%, and the proportion of pure electric taxis is 15.8%. We will comprehensively promote the upgrading of gasoline and diesel-powered cruise ships to clean energy. Implement green freight incentives and priority policies for the right of way for new energy trucks. The construction of green postal service has achieved initial results. The proportion of new energy express vehicles is nearly 40%, and the utilization rate of electronic waybills is 99%. Relying on the "revolving railway" pilot project, 3 million tons of bulk goods will be transferred from roads to railways, and six major projects, such as combined transportation of key goods by road and rail, will be implemented. The proportion of railway transportation from arrival to departure will increase year by year, and all coal used for production will be transported by rail. A statistical monitoring platform for energy conservation and emission reduction in Beijing’s transportation sector (Phase II) was built, and the National Energy Metrology Center (Urban Transportation) was approved.

5. The security service guarantee capability has been continuously improved.

Successfully completed a series of major events, traffic security. We will build a flat and efficient "three-level system and two-level command" dispatching mechanism, and successfully complete the traffic security tasks for major events such as the celebration of the 70th anniversary of the National Day, the Belt and Road Summit Forum and the Beijing Summit of the Forum on China-Africa Cooperation by regulating travel demand, increasing public transport capacity, strengthening order rectification and strengthening the safe operation of facilities. Accelerate the construction of transportation projects in the Winter Olympics, and complete the operation of Qinghe transportation hub and supporting roads, Songyan Road rerouting, Jingli Expressway and Hanquan service area. Successfully completed the transportation security tasks of various military transportation, national defense research transportation and other major activities.

The traffic guarantee of the city sub-center is strong. Improve the capacity of rail transit lines 6, 7 and Batong, and strengthen the rapid contact between the city sub-center and the central city. We will improve the road network system of the city’s sub-center, build the east extension of Guangqu Road and key roads such as Tongji Road and Canal East Street around the administrative office area, and start construction of the East Sixth Ring Road underground reconstruction project. Improve the service level of public transportation, build Tuqiao bus center station, and speed up the construction of Dongxiaoying center station, Eastern Xia Park comprehensive transportation hub and other hub stations. Open 22 customized bus lines connecting the administrative office area. Optimize the layout of internet rental bicycles to improve the accessibility and convenience of travel.

The traffic system runs smoothly and orderly, and is safe and reliable. We will improve the dual prevention and control system for traffic industry safety, and formulate the implementation plan for the reform and development of traffic industry safety production in this city. The number of accidents, deaths and injuries in traffic industry as a whole has decreased year by year, and no major accidents have occurred in production safety, and the management level of industry safety production has improved significantly. The road traffic safety level is generally stable, and the death rate per 10,000 vehicles at the end of the "Thirteenth Five-Year Plan" period is 1.47, showing a continuous downward trend.

(C) comprehensive traffic management to build a new pattern

1. Comprehensively upgrade the working mechanism of comprehensive traffic management.

Set up a leading group for comprehensive traffic management in Beijing, strengthen high-level coordination, comprehensively manage "traffic diseases" from a deeper level and in a wider field, and form a work pattern of "urban linkage, departmental coordination and social participation". The comprehensive law enforcement reform was basically completed, and for the first time, the centralized and unified law enforcement of all law enforcement categories in the transportation system and related administrative inspections and administrative enforcement was realized.

2. Further promote the rule of law by fine governance and joint governance.

Taking road parking management as a breakthrough, comprehensively strengthen the management of static traffic order. Motor vehicle parking order and Internet rental bicycle parking order have improved significantly. With the implementation of the road parking reform, the concept of "parking in place, parking payment, and punishment for violation of parking" is deeply rooted in the hearts of the people. With the full implementation of electronic toll collection for road parking, the inclusion of government non-tax revenue and standardized management as a symbol, the city’s road parking reform was promoted, and 76,000 road parking spaces were planned in the city, realizing the transformation from "manual cash charging mode" to "electronic charging mode" and "operational charging" to "administrative charging". Reasonably increase the supply of parking facilities and promote the construction projects of parking facilities in 29 residential areas in the central city and Tongzhou District. Realize the sharing of 330 parking lots and 28,000 parking spaces at different times, and make full use of existing parking spaces to alleviate the problem of "parking difficulties". 41 Park-and-Ride (P+R) parking lots have been built around rail stations, with an average utilization rate of over 80%. Introduce a financial incentive policy to encourage and promote social forces to participate in the construction and operation of motor vehicle parking facilities. At the end of the 13th Five-Year Plan period, there were about 4.247 million parking spaces in the city, of which 96.3% were allocated parking spaces. The Internet bicycle rental supervision and service platform was officially put into use, accessing the dynamic and static data of 900,000 bicycles from three companies. We will carry out special treatment of Internet rental bicycles, and plan 15,000 bicycle parking areas in the central city and Tongzhou District, standardize and guide Internet rental bicycle parking, and purify the urban environment.

Innovate the social governance system and continue to carry out traffic congestion control. According to the difficulty of governance, governance cycle and the degree of influence on the system, the blocking points in the city are divided into three levels, and the urban areas are linked to carry out rolling governance. Release the implementation plan of traffic congestion control around primary and secondary schools and hospitals, implement the main responsibilities of schools and hospitals and carry out regular monitoring, effectively alleviating the congestion around schools and hospitals. During the "Thirteenth Five-Year Plan" period, a total of 943 blocking points were managed.

We will strengthen the construction of a traffic environment ruled by law and make new progress in governing according to law. Thirteen local laws and regulations in the field of transportation, such as Regulations on Parking of Motor Vehicles in Beijing, Regulations on Management of Non-motor Vehicles in Beijing, Several Provisions on Investigating and Handling Illegal Passenger Transport in Beijing, and Interim Provisions on Controlling the Number of Passenger Cars in Beijing, were issued to provide legal support for cracking down on illegal activities and promoting the healthy development of the industry. Formulated 336 normative documents, such as the detailed rules for the implementation of network car management, the guidance on internet bicycle rental, and the opinions on private car sharing, which provided institutional support for solving the hot and difficult problems in Beijing’s traffic development. Actively and prudently formulate policies to deepen reform and promote the healthy development of the taxi industry, promote the transformation and upgrading of cruise vehicles, and standardize the development of online car. Implement the new version of the Regulations on the Management of Road Passenger Transport and Passenger Stations, and shut down six long-distance passenger stations such as Lize to ease the traffic pressure in the central city. Intensify the crackdown on traffic violations, build a "one group and two offices" organizational structure, and establish a long-term mechanism for "black car" governance; We will issue a special action plan for "black car governance", promote entrusted law enforcement and administrative enforcement, and form a closed loop of law enforcement. Formulate law enforcement rules, law enforcement cooperation measures, and promote the standardization of law enforcement. It took the lead in launching off-site law enforcement work for highway overrun in China, and the overload rate of the whole road network remained within 1% for 10 consecutive years, which was at the leading level in China.

Generally speaking, during the 13th Five-Year Plan period, the construction of comprehensive transportation system achieved remarkable results, and the modernization of transportation governance system and governance capacity took new steps. At the same time, the transportation industry is in a critical period of transformation and development, and the contradiction of insufficient imbalance in transportation development is still outstanding. Residents still face many "pain points" such as long commuting distance, inconvenient travel and traffic congestion, and there are still some weak links in the transportation system:

First, the optimization of transportation structure and energy structure needs to be strengthened. There is still a big gap between the proportion of green travel and the planning goal, and the difficulty of regulating the proportion of travel is increasing. It is necessary to further strengthen the concept of green travel in the whole society, optimize the supply of green travel and the regulation policy of car ownership. The transportation sector is far from the goal of carbon neutrality in peak carbon dioxide emissions. In addition to increasing the proportion of green travel, it is necessary to vigorously promote new energy sources of transportation and continuously reduce carbon emissions in the transportation sector.

Second, the interconnection of transportation facilities at a higher level needs to be strengthened. The level of inter-city railway interconnection in Beijing-Tianjin-Hebei region still needs to be improved, and the support of rail transit for the coordinated development of Beijing-Tianjin-Hebei and the spatial pattern of "one core and two wings" is still insufficient; The level of rail transit network is still not perfect, the commuting function of suburban railways has not been fully exerted, and the "four networks integration" of rail transit (trunk railway, intercity railway, suburban railway and urban rail transit) is still in its infancy, and the overall network operation efficiency is still not high. The hierarchical structure of urban road network needs to be optimized, the implementation rate of low-grade roads such as secondary trunk roads and branch roads is low, and there is still a gap between the road network density and the development requirements. The site coverage of ground bus lines relying on urban road network needs to be improved, and the efficiency and reliability of bus travel need to be improved. The environment for walking and cycling still needs to be improved, and there are still shortcomings in the safe and continuous right of way. The "multi-network integration" among rail transit, ground bus, bicycle and pedestrian networks needs to be strengthened. The progress of transportation hub construction is still lagging behind, and the role of supporting the connectivity of various modes of transportation is still not strong.

Third, the modernization of transportation governance system and governance capacity needs to be strengthened. The three-dimensional and modern comprehensive transportation system has not been fully established, barriers between regions, industries and departments still exist, and the institutional mechanism for the integrated development of various modes of transportation is still not perfect. The extensive management mode that relies too much on administrative means has not been fundamentally changed, and the means of market, economy, law and technology are insufficiently used. The market governance rules need to be improved, and the unified, open and competitive modern transportation market system is still not perfect. Social participation in traffic governance still needs to be further expanded, and the awareness of social organizations’ autonomy according to law, spontaneous self-discipline and public civilized travel, co-construction and sharing needs to be strengthened.

Fourth, the deep integration of the transportation industry and new technologies needs to be strengthened. "internet plus Traffic" is profoundly changing the way residents travel. The transformation and upgrading of traditional industries are still lagging behind, and the deep integration of new technologies and industry management is still insufficient. There is still a gap between the service mode and service quality of transportation and the people’s expectations of individualization, diversification and quality of transportation in the new era. It is still in the exploratory stage to promote the structural reform of transportation supply side with the help of new technologies.

Second, the development environment

(A) the situation requires

During the "14th Five-Year Plan" period, the development of Beijing’s transportation industry faced a series of new opportunities and challenges, which put forward new requirements for Beijing to improve its comprehensive transportation system.

In September 2019, when General Secretary of the Supreme Leader attended the opening ceremony of Beijing Daxing International Airport, he emphasized that urban rail transit is the development direction of transportation in modern big cities. Developing rail transit is an effective way to solve the disease in big cities, and it is also an effective way to build a green city and a smart city. Beijing should continue to vigorously develop rail transit, build a comprehensive, green, safe and intelligent three-dimensional modern urban transportation system, always maintain the most advanced international level, and build a modern international metropolis.

Building a strong transportation country requires three changes in transportation development, that is, promoting transportation development from pursuing speed and scale to paying more attention to quality and efficiency, from relatively independent development of various modes of transportation to paying more attention to integration and integration, and from relying on traditional factors to paying more attention to innovation.

National, regional and urban development strategies require the transportation system to be well supported, firmly grasp the positioning of the "pioneer" of transportation, integrate into building a new development pattern, build a domestic and international dual-cycle core hub, implement the coordinated development strategy of Beijing-Tianjin-Hebei, implement the overall urban planning, promote the construction of "two districts" and promote a new round of urban renewal, thus providing basic guarantee for the implementation of major strategies.

The people’s demand for "beautiful travel" is constantly rising, which puts forward higher requirements for the quality of transportation development. Transportation development should adhere to the "people-oriented" concept and strive to provide high-quality travel services for the people.

Achieving a steady decline after the peak of carbon puts forward higher requirements for the green development of transportation. The carbon emissions in the transportation sector account for a high proportion of the carbon emissions of the whole society, and the task of reducing emissions is very heavy. We must take positive actions and take solid steps during the "14 th Five-Year Plan" period.

Scientific and technological innovation and the development and application of new technologies are profoundly changing the traditional transportation development mode. The national system layout of "new infrastructure" and Beijing’s construction of a global digital economy benchmark city will accelerate the transformation and upgrading of transportation development.

(B) changes in demand

1. Passenger demand

During the "Fourteenth Five-Year Plan" period, the functions of non-capital will be further eased, and the functional core area of the capital will gradually "calm down", and the travel demand of urban sub-centers, multi-point new cities and areas around Beijing will increase significantly. The people’s demand for the quality of transportation has been significantly improved, and the transportation demand will be further diversified, personalized and differentiated. The transportation system will further deepen the structural reform of the supply side and realize more flexible dispatching organization to meet the needs of different regions and different types of travel and provide convenient services.

It is estimated that in 2025, the total daily average number of trips in the central city will reach about 41 million, an increase of about 13% compared with 36.19 million at the end of the Thirteenth Five-Year Plan period. The passenger flow exchange between the sub-center of the city and the central city has increased significantly. With the continuous improvement of the service capacity of "one city, two events" (Beijing Capital International Airport and Beijing Daxing International Airport) and the continuous improvement of the intercity railway network, it is expected that the passenger volume of civil aviation and railways in the city’s foreign passenger transport will continue to rise, and the passenger volume of highways will show a downward trend.

2. Freight demand

During the "14th Five-Year Plan" period, with the deepening of non-capital functions and transportation structure adjustment, the total supply and demand of materials will increase steadily, and it is estimated that it will reach about 387 million tons in 2025 (about 370 million tons at the end of the "13th Five-Year Plan" period), and road, railway, aviation and pipeline transportation will show a differentiated development trend. The "revolving iron" of bulk goods will continue to advance, and the road freight volume will decrease slightly. The material circulation zones in the south, southeast and east will be strengthened, and Beijing Daxing International Airport, Airport Economic Zone and Jingping Transit Railway Integrated Logistics Hub Industrial Park will become new material circulation areas. New modes and formats of postal express industry are constantly emerging, the categories of productive materials will decline, and the demand for living materials will continue to grow.

(3) Development trend

On the basis of the external situation requirements of traffic development and the changes of passenger and cargo transportation demand characteristics, the future traffic will present the following main development trends:

Integration. The overall efficiency of the comprehensive transportation system has been continuously improved, and the multi-mode transportation network has been integrated and developed. Relying on the MaaS platform, the one-stop service capacity across modes and regions has been significantly improved, and passenger combined transport and cargo multimodal transport have been realized.

Humanization. From car-based to people-oriented, we pay more attention to meeting the people’s increasingly diversified and personalized travel needs, and the differentiated transportation service supply model is constantly enriched.

Facilitation. The rapid traffic network has been gradually improved, realizing the coverage of large-capacity and rapid traffic passages between traffic hot spots, facilitating the transfer between various modes, and greatly improving the efficiency of residents’ commuting. The proportion of public transport service population and posts has continued to increase, making it more convenient for residents to travel.

Greening. In order to achieve a steady decline after the peak of carbon, the work of energy conservation, emission reduction and carbon reduction in the transportation field will continue to advance in depth, the proportion of green travel will continue to increase, the transportation structure will continue to be optimized, and new energy vehicles will accelerate the replacement of traditional fuel vehicles.

Wisdom. The transportation industry has accelerated the transformation and upgrading of digitalization and intelligence, greatly improved the level of scientific and technological innovation, and realized the informationization and intelligence of the whole chain of transportation construction, operation, service and management.

Intensive. In the context of resource and environmental constraints, the transportation system has strengthened intensive and efficient utilization of resources, realized market-oriented allocation of factors, and improved the quality and efficiency of transportation development.

Modernization. The transportation system is more comprehensive, green, safe and intelligent. The level of transportation civilization in the whole society has been continuously improved, the traffic order and traffic operation have been continuously improved, and the modernization level of transportation governance system and governance capacity has been significantly improved.

Third, the overall requirements

(A) the guiding ideology

Adhere to the guidance of the Supreme Leader’s Socialism with Chinese characteristics Thought in the new era, fully implement the spirit of the 19th National Congress of the Communist Party of China and the previous plenary sessions of the 19th National Congress, thoroughly implement the spirit of a series of important speeches made by the General Secretary of the Supreme Leader to Beijing, adhere to the general tone of striving for progress while maintaining stability, implement the new development concept completely, accurately and comprehensively, adhere to the development of the capital as the guide, and thoroughly implement the strategies of humanistic Beijing, high-tech Beijing and green Beijing with the theme of promoting high-quality development. Taking deepening the structural reform on the supply side as the main line, taking reform and innovation as the fundamental driving force, and meeting the people’s growing needs for a better life as the fundamental purpose, we will make overall plans for development and safety, firmly grasp the positioning of transportation as a "pioneer", and strive to promote the transformation of transportation development from pursuing speed and scale to paying more attention to quality and efficiency, from relatively independent development of various modes of transportation to paying more attention to integration and integration, and from relying on traditional factors to paying more attention to innovation. We will give priority to slow travel, public transport and green, build a comprehensive, green, safe and intelligent three-dimensional modern urban transportation system, optimize supply, regulate demand, strengthen governance, build first-class facilities, first-class technology, first-class management and first-class services, and build a first-class transportation that is satisfactory to the people and powerful, so as to provide support for strengthening the function construction of "four centers", improving the level of "four services" and the coordinated development of Beijing, Tianjin and Hebei.

(2) Basic principles

Adhere to the people as the center. Adhere to people-oriented, demand-oriented, implement "slow travel priority, public transport priority, green priority", realize the harmonious and orderly operation of the comprehensive transportation system, break down regional and industry barriers, optimize the connection and transfer between various modes of transportation, and meet the needs of travelers for full-time travel services.

Insist on serving the overall situation. Guided by the development of the capital, we will firmly grasp the position of "pioneer" in transportation, give play to the role of "pioneer" in basic, pioneering, strategic and service transportation, adhere to the urban development mode guided by transportation, support the optimization and adjustment of urban spatial layout and functions, support the functional construction of "four centers" and the improvement of "four services" in the capital, support the coordinated development of Beijing, Tianjin and Hebei, and support the accelerated construction of a modern economic system and a new development pattern.

Adhere to high-quality development. We will promote quality change and the transformation of transportation development mode, run the new development concept through the whole development process and all fields, take safety, convenience, high efficiency, green and economy as the value orientation, continuously improve the index system, statistical system, policy and regulation system and performance evaluation system of high-quality transportation development, and promote high-quality transportation development with a systematic concept.

Adhere to integration and development. Promote efficiency change and development path change, build a more economical and efficient modern comprehensive transportation system, coordinate the promotion of hard connectivity and soft connectivity of various modes of transportation, and strive to promote infrastructure connectivity, transportation services, technical standards compatibility, factor resource sharing, and institutional mechanisms to improve the overall efficiency of comprehensive transportation.

Adhere to the innovation drive. Realize service innovation through technological innovation and mechanism innovation. Take digitalization as the main engine driven by innovation, accelerate the deep integration of new technologies and transportation, promote the upgrading of equipment technology, accelerate the development of new formats and new models, and comprehensively promote the digital transformation and intelligent upgrading of transportation.

Adhere to comprehensive management. Adhere to "optimizing supply, regulating demand, and strengthening governance" to promote comprehensive traffic management. On the basis of optimizing supply, we will continue to promote structural reform on the supply side and build a green transportation system with first-class facilities, first-class technology, first-class management and first-class service; With the goal of regulating demand, adhere to the two-way efforts of "limiting" and "pushing", continuously optimize the management of car ownership, and help cars to turn more into green travel, forming a more reasonable traffic travel structure; With the guarantee of strengthening governance, we will continue to modernize the transportation governance system and governance capacity to ensure the matching of transportation supply and demand and the efficient and resilient operation of the capital transportation.

Adhere to the safety bottom line. Safety is the red line, bottom line and lifeline of transportation, and ensuring life safety is the basic premise of transportation development. Coordinate development and safety, strengthen the improvement of personnel quality, improve the quality of vehicle equipment and facilities, improve the safety foundation of operating environment and management, strengthen the investigation and management of hidden dangers, implement dynamic monitoring and early warning and emergency rescue capabilities, and build safe traffic.

(III) Main objectives

1. Vision for 2035

By 2035, we will basically build a comprehensive, green, safe and intelligent three-dimensional modern urban transportation system, build first-class facilities, first-class technology, first-class management and first-class service, and build a first-class transportation that is satisfactory to the people and has strong guarantee.

-external transportation system. Beijing-Tianjin-Hebei has become an important pole of the national comprehensive three-dimensional traffic network, forming a comprehensive, multi-channel, three-dimensional, large-capacity and fast traffic spindle with the Yangtze River Delta, Guangdong-Hong Kong-Macao Greater Bay Area and Chengdu-Chongqing economic circles, building a multi-mode, multi-channel and convenient traffic corridor between Beijing-Harbin and Beijing-Tibet, and forming a Beijing-extension corridor. Beijing-Tianjin-Hebei urban agglomeration took the lead in building an intercity railway network, forming "Beijing-Tianjin-Hebei on the track". It is the first to realize the two-hour access within the Beijing-Tianjin-Hebei urban agglomeration and the three-hour access to major cities across the country, and the "Global 123 Express Freight Flow Circle" (one day in China, two days in neighboring countries, and three days in major cities around the world).

-transportation hub system. As an international comprehensive transportation hub city, Beijing links Tianjin, Xiong ‘an, Shijiazhuang and other cities to build a Beijing-Tianjin-Hebei international comprehensive transportation hub cluster facing the world. Around the Beijing Capital International Airport and Beijing Daxing International Airport, two international aviation hubs, 10 national railway passenger hubs such as Beijing Railway Station and several regional passenger hubs, we will build a coordinated, integrated and efficient integrated transportation hub system. Create a global international postal express hub cluster in Xiong ‘an, Beijing and Tianjin.

-Urban comprehensive transportation system. Create a one-hour "door-to-door" commuter circle, and form a comprehensive urban transportation system with multi-network integration and convenient connection such as rail transit, ground bus, walking and cycling. Promote the "four networks integration" of rail transit, form a rail network of more than 2,500 kilometers, and effectively support the development and commuting needs of urban groups with a population of more than 50,000 in the capital circle. Ground bus, slow traffic, taxis (including cruise cars and network cars) and passenger cars are efficiently connected with rail transit, achieving coordinated development in various ways and improving the quality of transportation services. Build a pedestrian and bicycle-friendly city, form a continuous and safe slow traffic network, and slow traffic has become a part of citizens’ healthy life. Innovate the service mode, realize the real-time dynamic response to the traffic demand, and let the people enjoy "travel is service". Traffic travel is safe and orderly, and the toughness of the traffic system is significantly improved.

-Comprehensive management system. Form an institutional mechanism that adapts to the high-quality development of transportation and a unified, open, competitive and orderly transportation market, build a new comprehensive transportation governance mechanism, and realize the modernization of transportation governance system and governance capacity. Improve the comprehensive transportation big data center system, comprehensive transportation information platform and smart travel platform, build a digital urban transportation parallel system, realize all-round perception of urban transportation system, and provide support for facility planning and construction, traffic management decision-making, operation and scheduling organization and travel service. Develop the advanced transportation culture of international metropolis, form the brand of capital transportation civilization, highlight the fair, healthy and rational transportation civilization, and lead the development of national transportation civilization. The comprehensive transportation laws and regulations system is complete, and the legal systems of different modes of transportation are effectively connected, forming a good legal environment for the industry. The requirements of the rule of law run through the whole process of comprehensive transportation planning, construction, management, operation service and safety production. The establishment of a new supervision mechanism based on credit has significantly enhanced the awareness of the rule of law in the transportation system.

2. Development goals during the Tenth Five-Year Plan period

A comprehensive, green, safe and intelligent three-dimensional modern urban transportation system has been initially established, and the transportation development has reached a new level.

-The international connection is of high standards, and the image of the country has been significantly improved. The ability of international transportation has been greatly improved, and the function of "one city, two games" international hub has been significantly enhanced, forming an important link between domestic and international dual circulation and mutual promotion. Accelerate the construction of airport collection and distribution system, improve the efficiency of airport land traffic operation, and support the construction of a world-class airport city with international influence.

—— Regional coordination is efficient, and the level of transportation integration in Beijing, Tianjin and Hebei has improved significantly. Intercity railways are smooth and convenient, the radiation capacity of expressways is further improved, the "bridgehead" traffic framework of urban sub-centers is basically formed, and the "one core and two wings" traffic connection is convenient and fast. The level of regional traffic integration and public transportation has been significantly improved. A 2-hour traffic circle of Beijing-Tianjin-Hebei urban agglomeration and a 1-hour commuter circle of Beijing metropolitan area have been initially established, basically achieving full coverage of one-hour rapid transit service within the city, which strongly supports the development of world-class urban agglomerations with the capital as the core.

-Serving the capital at a high level, and the level of "four services" has been significantly improved. Guided by the development of the capital, the service support capacity of major events has been significantly enhanced, and the level of international services has been significantly improved; New breakthroughs have been made in digital and intelligent transformation, and the level of transportation science and technology and innovation ability have continued to rise; Courtesy of traffic civilization, credit travel and voluntary service have become a common practice, and the degree of traffic civilization has been greatly improved; The quality and efficiency of transportation have been continuously improved, and citizens’ satisfaction with transportation has been continuously improved.

-The industry has developed with high quality, and the quality and efficiency of traffic development have been significantly improved. The transportation structure, transportation structure and energy structure have been continuously optimized, and the level of green and low-carbon development has been significantly improved; A modern comprehensive transportation system with the characteristics of the capital has basically taken shape, and the "four networks integration" of rail transit has made a substantial breakthrough, and the integration development level of rail transit, ground bus and slow-moving system has been significantly improved; The development level of intelligent, safe, green and shared transportation has been significantly improved, and the "one-stop" travel service in all modes and full time has been basically improved; Strengthen regional planning and urban-rural planning, and make new progress in providing equal basic public transport services for all travelers; The digital economy has become a new kinetic energy for development, the transportation industry has continued to grow and the labor productivity has continued to increase.

—— Comprehensive management has high efficiency, and the modernization level of traffic management has been significantly improved. The basic institutional system in all fields of traffic governance has been basically improved, the rules, norms and standards of market governance have been further improved, a new regulatory mechanism based on credit supervision has been basically established, a unified and open transportation market has been basically formed, and the governance pattern of co-construction and co-governance and sharing has been further improved. The level of safe traffic construction has been significantly improved, the casualty rate of traffic accidents has been significantly reduced, the ability of emergency response has been significantly enhanced, and the ability of overall development and safety has been further enhanced.

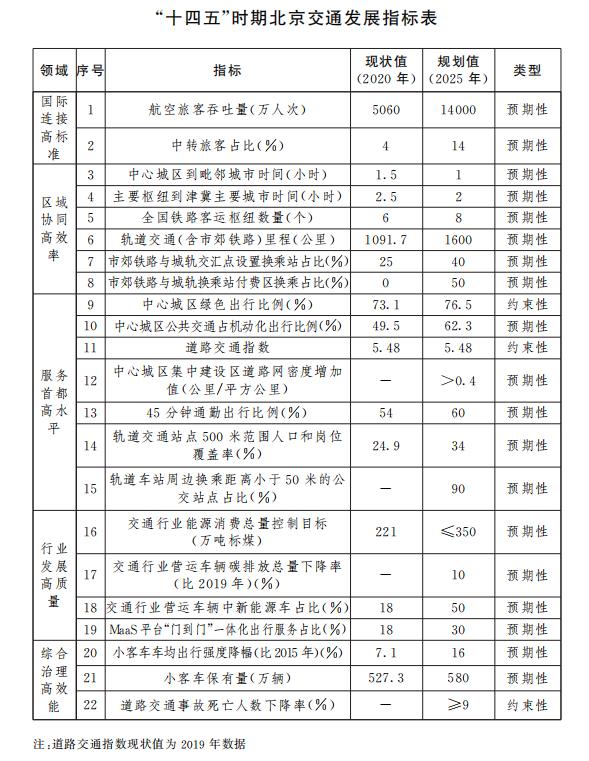

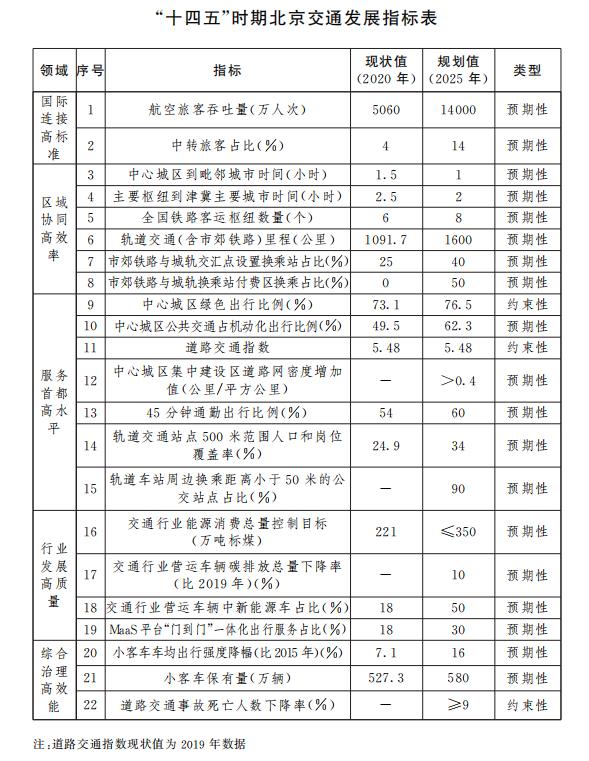

A total of 22 planning indicators are set around five aspects: "high standard of international connection, high efficiency of regional coordination, high level of service to the capital, high quality of industry development and high efficiency of comprehensive management", of which 3 are binding indicators and 19 are expected indicators.

IV. Main tasks

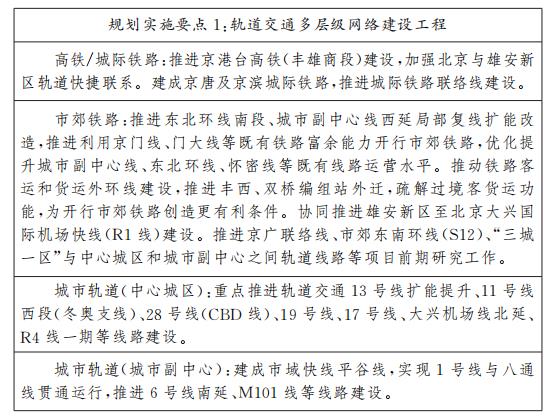

(1) Promote the high-quality integrated development of rail transit.

With the goal of high-quality networked operation services, we will pay equal attention to the construction of new rail transit lines and the upgrading of existing lines, strive to improve the level of lines and networks, build a "four-network integration" express commuter network, and expand the one-hour commute circle; Efforts should be made to break through the technical standard barriers, improve the integration of urban rail transit and suburban railways, and realize "one system, one network operation, one-vote access and one-stop security inspection"; Efforts should be made to break through the bottleneck of the network, strengthen the overall transportation efficiency of the network, and promote the resource sharing, high-quality network operation and cost reduction and efficiency improvement of the whole network; Efforts will be made to strengthen the integration of rail network with urban space, urban functions, citizens’ travel and value-added services extended from it, improve the "rail+land" model, and build "urban life on the track".

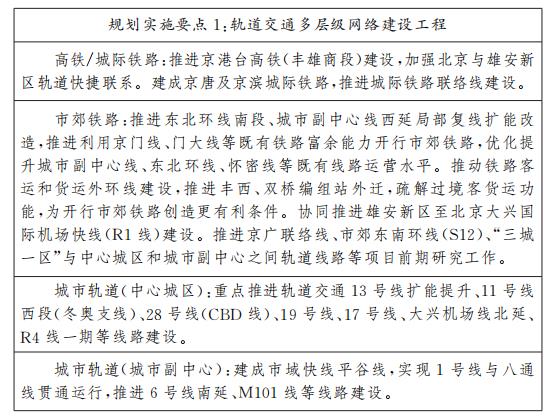

1. Fully implement the track construction plan and promote the construction of multi-level track network.

Basically built "Beijing-Tianjin-Hebei on the track". We will implement the master plan of the railway hub in the core area of Beijing, Tianjin and Hebei, focus on the construction of high-speed rail and intercity railway, and promote the construction of major rail transit infrastructure across regions. Promote the construction of intercity railway links, support the development of urban sub-centers and "one city, two games" areas, and enhance the effect of urbanization. Construct a convenient and fast suburban railway system in the capital, and formulate a suburban railway network plan and a five-year construction action plan. Promote the construction of railway passenger and freight outer ring road and the relocation of large railway marshalling yards to create favorable conditions for the operation of suburban railways; Based on ensuring and serving the local urban material supply and distribution, we will promote the capacity expansion and renovation of some railway freight stations and upgrade facilities. By 2025, the operating mileage of suburban railways will strive to reach 600 kilometers.

Encrypt and improve the network in the central city. Complete the second-phase (and second-phase adjustment) rail transit construction plan in Beijing, start the implementation of the third-phase rail transit construction plan, and encrypt the rail transit network in the central city. During the "Fourteenth Five-Year Plan" period, the operating mileage of new urban rail transit is about 300 kilometers, and the total mileage of rail transit (including suburban railways) will strive to reach about 1600 kilometers.

The city sub-center will speed up the construction of the rail network. Strengthen the function of transportation hub, build a comprehensive transportation hub of sub-central station in the city, promote the "four networks integration" of rail transit, and simultaneously promote the function construction of urban terminals. New urban sub-center rail network will be built to improve the service capacity of rail transit, and a rail transit pattern of "one ring, six horizontals and four verticals" will be initially formed.

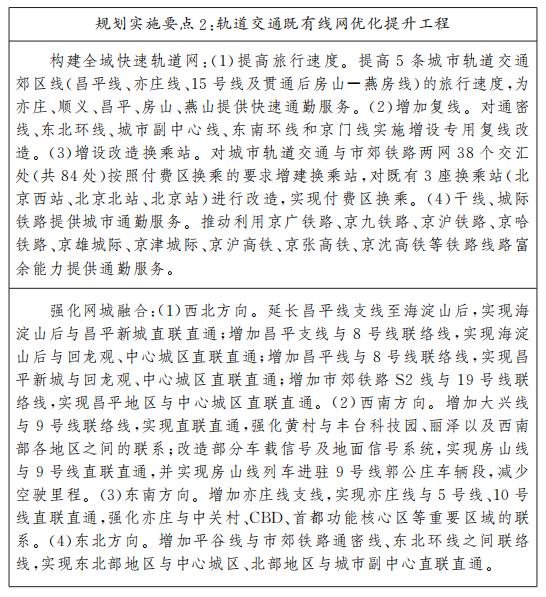

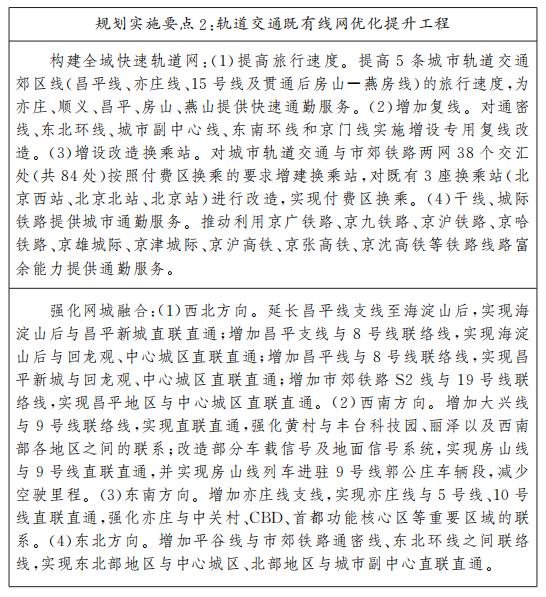

2. Promote the "four networks integration" and build a global fast rail network.

Build a global rapid rail network and accelerate the realization of one-hour commuting. We will promote the speed-up transformation of suburban lines of urban rail transit, and increase the average travel speed by increasing cross-line lines, purchasing express trains and running express trains at large stations. Add double tracks to suburban railways such as the city’s sub-center line and the northeast ring road to promote the realization of high-frequency bus service for suburban railways. According to the transfer requirements in the payment area, transfer stations will be built at the intersection of urban rail transit and suburban railway, and the existing transfer stations will be upgraded to promote the integration of the two networks. Promote the use of trunk railways and intercity railways to provide commuting services for cities (groups), increase peripheral stops, and reduce the traffic pressure in the central city.

Break through technical standards and strengthen the integration of urban rail transit and suburban railways. Unify the interface standards of various professional network equipment in urban rail transit, and establish a unified basic support system through the unification of major equipment types, important system standards and interface standards. Promote vehicle compatibility, adopt smaller gauge of urban rail vehicles, and install double-flow vehicles with two sets of on-board signals and power supply systems to realize vehicle compatibility and cross-line operation. Promote the compatibility of ticketing systems, and realize "one-vote communication" through the interconnection of ticketing apps, one-code communication, transfer in payment areas and joint transportation. Implement the new mode of "credit+smart security inspection", and realize "one-stop security inspection" through the docking of human inspection standards and the unification of physical inspection standards.

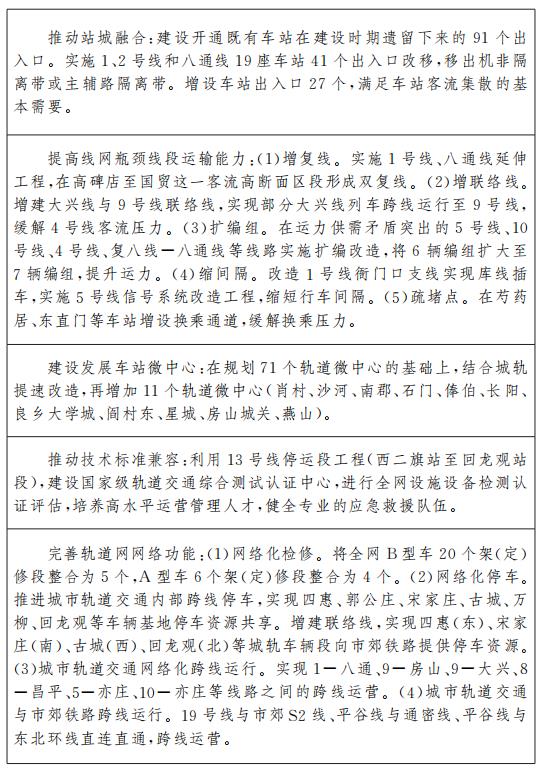

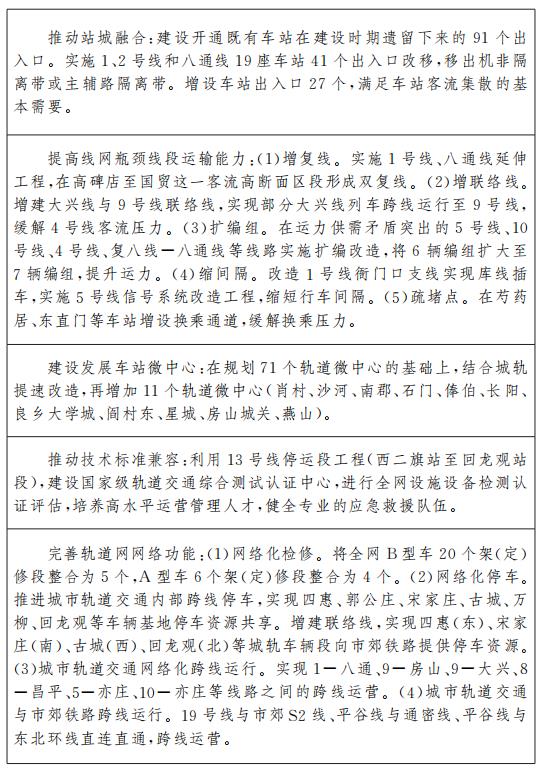

3. Promote integrated development and increase the proportion of rail transit trips.

Construct "urban life on the track" and improve the competitiveness of rail transit for passenger cars. Strengthen the integration of network and city, improve the matching degree between rail network and urban commuting demand by increasing branch lines and tie lines, and realize direct connection and direct connection between related important areas. Promote the integration of stations and cities, promote the construction of entrances and exits of legacy stations, implement the relocation of entrances and exits with unreasonable positions, add entrances and exits of stations, and promote the connection of entrances and exits with surrounding buildings, underground passages and blocks, improve the service level of urban rail transit and increase the attractiveness of passenger flow. Promote multi-network integration, promote the deep integration of rail transit and ground bus, form a network diagram, unify the naming of stations, and shorten the transfer distance between ground bus stations and subway stations; Set up non-motor vehicle parking areas at the entrances and exits of existing subway stations; Add car park-and-ride parking lots (P+R) at the remote stations of suburban railways and subways. Strengthen the station value-added services, optimize the layout of public space facilities and passenger flow organization in the station, add convenience service facilities, and form a networked convenience service.

Strengthen the overall transportation efficiency of the rail network and increase the proportion of rail transit trips. By adding double tracks, expanding marshalling and shortening the interval between trains, the transportation capacity of bottleneck segments is improved and the transportation capacity of related lines is released. By adding tie lines and crossing lines, the flow direction of passenger flow is changed and the pressure of passenger flow passing through the lines is shared. Add transfer channels for transfer blocking points to ease the transfer pressure. Build and develop station micro-centers, balance the passenger flow of rail network, supplement the customers for the segments, directions and time periods with low passenger flow, and improve the overall transportation efficiency of the network. At the same time, the urban pattern of "one station, one city", "one line, one string of cities" and "one network, one group of cities" will be gradually formed, further enriching the "urban life on track".

4. Improve the network function of the rail network and realize high-quality network operation.

According to the idea of "maintenance function of the far-end depot layout in the central city, parking in the near-end depot", we will promote the networked maintenance layout, improve the maintenance efficiency, especially turn the maintenance base vacated by the near-end depot into a parking lot, promote the networked parking layout, promote the cross-line parking of the urban rail transit network, and realize the sharing of parking resources in vehicle bases. By using the connecting line of urban rail transit network and parking resources of the depot, cross-line operation and two-way unbalanced operation are organized, and multi-way running is organized by using the midway turn-back line to realize the coupling of traffic flow and passenger flow, which greatly reduces costs and increases efficiency. Organize the cross-line operation of urban rail transit and suburban railway to improve the commuter service level of suburban railway. Promote the digital transformation and intelligent upgrade of rail transit operation business, build the next generation of smart rail transit, and comprehensively improve the operation safety, service level and operation efficiency of rail transit.

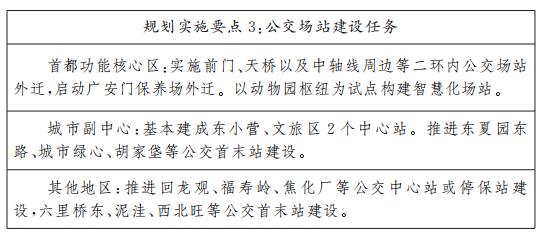

(B) to create a convenient and efficient ground bus system.

Continue to optimize the ground bus network, promote the integration of ground bus and rail transit, and form a network of rail and bus. Promote the network operation of ground bus, strengthen basic capacity building and priority policy guarantee, and improve the capacity and level of ground bus service.

1. Optimize the ground bus network and promote the integration of the two networks.

Promote the integration of public transport and rail functions. Subdivide the public transportation market, give full play to the unique advantages of rail and ground bus, and form a complementary development model of public transportation in rail service and short-distance travel in ground bus service. In areas with dense rail network, strengthen ground bus connection and microcirculation, reduce long, large lines and repetitive routes, and in principle, the local repetitive routes with the track shall not exceed 5 kilometers; In suburban areas where rail transit coverage is insufficient, develop long-distance bus lines appropriately; For oblique travel with high rail transfer coefficient, increase direct bus lines.

Promote the integration of public transport and rail network. Combined with the third phase of rail transit construction planning, the bus network planning is compiled. Give full play to the advantages of flexible ground bus layout, accurately match the bus travel demand and continuously optimize and adjust the bus lines in view of the problems such as blank service track lines, inconvenient connection of track stations and high rail transfer coefficient. On the basis of meeting the basic service demand, we will continue to carry out demand-responsive public transport services; Actively expand a variety of service methods to provide more convenient services for the masses, especially those in remote areas. Combine the road conditions, line functions and passenger demand and other factors to optimize and adjust the structure of bus models.

Promote the integration of public transport and rail stations. Combined with the functional positioning of public transport and rail, the planning of public transport and rail stations will be coordinated, and a well-distributed and complementary site layout will be formed to ensure the full coverage of public transport stations within a radius of 500 meters in the centralized construction area of the central city and improve the proportion of serving population and jobs. Improve the transfer efficiency of ground bus and rail, increase the proportion of bus stops with transfer distance less than 50 meters around rail stations, and shorten the transfer distance.

Promote the integration of public transport and rail operation. Ensure that the bus micro-circulation line connecting with the track station is connected with the service time at the beginning and end of the track, which is convenient for passengers to transfer and travel; Flexible adjustment of bus lines and capacity in combination with peak, flat peak rail and ground bus passenger flow demand; After the track stops at night, give full play to the role of ground bus in urban travel and ensure the full coverage of urban public transport service time in the central city.

2. Promote network operation and improve the level and efficiency of public transport services.

Improve the use efficiency of bus lanes. Revise the local standards of bus lanes, complete the overall planning of bus lanes, and promote the continuous networking of bus lanes. Study and optimize the bus lane access policy, strengthen refined management, and fully improve the utilization rate of road resources. Strengthen the enforcement of bus lanes.

Improve the support capacity of bus stations. Promote the construction and handover of bus stations and the upgrading and transformation of bus platforms. Solve the parking maintenance function of the bus station in the functional core area of the capital, speed up the implementation of the planning of the bus station outside the central city, and create a convenient, three-dimensional and comprehensive new station. Make overall plans to promote the construction of smart bus stations, and improve supporting energy facilities simultaneously with the construction of bus stations. Give priority to the space under the bridge in the layout of bus stations.

Improve the network dispatching ability of public transport. Promote the transformation from three-level dispatching to two-level dispatching command system, implement regional flexible dispatching, and improve the matching degree between supply and demand and the efficiency of resource utilization. Research on breaking the boundaries between vehicles, parking lots, lines and management, completing the overall design of networked operation, and realizing the coupling of passenger flow and vehicles and efficient and resilient operation. By 2025, the punctuality rate of ground bus trunk lines will reach 85%, and the average full load rate of vehicles will reach 65%.

3. Build a bus network of several sub-centers in cities to provide convenient services.

Provide fast commuting service with the central city. Optimize the operation organization of bus lines, and form an efficient operation mode of "one for many+connecting and transferring". The central city and the sub-center of the city rely on the expressways such as Jingtong, Jingha and Guangqu Road to realize the rapid passage in the middle section. Strengthen the connection at both ends, rely on the micro-circulation line to go deep into the block and office building, and do a good job of connecting and transferring with bus trunk lines and subway stations. Vigorously develop point-to-point customized bus service mode and shorten the commuting time in the whole process of public transportation.

Deepen the integration of ground bus in urban sub-centers and improve the service efficiency of network. Further integrate and optimize the bus network of the city sub-center, take the city sub-center as a pilot, strengthen the integration of the rail and bus networks, continuously optimize the bus lines, and form a rail bus network. Develop diversified public transport and demand-responsive public transport services, and continuously increase a number of customized bus lines. Strengthen the bus connection between the city sub-center and Shunyi, Daxing, Pinggu, Yizhuang and other surrounding areas and characteristic towns.

Strengthen public transport links with the three northern counties and provide fast access to Beijing. Optimize the bus routes of the three northern counties to Beijing and strengthen the bus connection with the sub-center area of the city. Use market-oriented means to operate customized express buses between the city and the three northern counties, study the traffic support policies, and realize point-to-point rapid commuting. Implement centralized remote security inspection of buses and customized express buses to reduce the detention time of checkpoints and realize rapid access to Beijing. Innovate the organization mode of cross-regional traffic construction and build a regional intelligent traffic management command platform.

Accelerate the construction of supporting bus lanes, roads and stations. Improve the bus lane system, and comprehensively improve the bus running speed of the channel connecting with the central city. Relying on the main bus lanes in the city sub-center, a number of bus lanes are planned to form a continuous bus lane network. Accelerate the construction of bus stations.

4. Improve the public transport policy system and thoroughly implement the public transport priority strategy.

Study and establish the working mechanism of bus lane planning, planning, operation and maintenance, and provide guarantee for promoting the implementation of bus lanes. Study and establish a linkage mechanism among government financial subsidies, operational service standards and evaluation, ticket fares and bus priority guarantee measures for public transport operation services. Deepen the reform of the ground bus industry, clarify the responsibilities of government and enterprises, promote enterprises to increase revenue and reduce expenditure, reduce costs and increase efficiency, and promote the high-quality development of ground bus.

(3) Building a pedestrian and bicycle friendly city

Build a wide coverage, continuous and safe, environment-friendly and cultural network system of walking and cycling, and give full play to the important role of slow traffic in short-distance travel and the "last mile" connection of public transportation. According to the concept of complete streets, we should plan and design streets and blocks suitable for slow travel, further enhance the attraction of walking and cycling, and make slow traffic a part of citizens’ healthy life.

1. Build a safe and continuous slow-moving network to ensure the right of slow-moving traffic.

Gradually improve the slow-moving infrastructure network in different areas. Create a slow network with continuous system and convenient access in the functional core area of the capital, sub-centers of the city and key functional areas. Make a special plan for the slow-moving system and further improve the infrastructure of walking and cycling with the construction of urban roads. Further clarify the right of pedestrian and bicycle traffic on the secondary trunk roads and roads below the central city, systematically rectify the environment of pedestrian and bicycle travel, organize and implement the addition of pedestrian walkways and bicycle lanes missing in some sections of the roads within the Fifth Ring Road, and realize the continuous networking of slow-moving systems. By 2025, all roads with a width of 12 meters or more within the Fifth Ring Road will be divided into non-motor vehicle lanes, and bicycle priority signs will be added to all mixed roads.

Improve the walking and cycling environment of urban sub-centers. Priority should be given to ensuring the right of walking and cycling, breaking through blocking points and breakpoints, and building a continuous and comfortable slow-moving large network along the river, along the green and along the road to realize dense road network, connected nodes and orderly speed, with the total mileage of walking and cycling lanes reaching about 1500 kilometers. Increase bicycle transfer (B+R) facilities around track stations.

Strengthen the integration of urban road slow-moving system with garden greenway and waterfront road. Strengthen the integration of urban roads, river patrol roads and greenways, study and formulate the planning and design standards for the integration of three networks, and prepare the conceptual plan for the integration of typical river patrol roads or greenways and urban roads. Carry out research on the opening of parks and greenways to city slow traffic system, and vigorously promote the integration of greenways and city slow traffic system Unicom. Make full use of greenway resources, form a walking, running and cycling system for leisure and fitness, and create a good slow-moving environment for the citizens. During the "Fourteenth Five-Year Plan" period, 42 kilometers of greenways from the Olympic Forest Park to the Ming Tombs Reservoir, Yongding River, Chaobai River and other greenways were completed, and 350 kilometers of greenways were built. Carry out the transformation of the slow-moving system of the existing urban river patrol road, strengthen the integration of nodes, and ensure the effective connection between the waterfront road and city slow traffic system through engineering transformation and optimization of guiding signs. On the basis of ensuring the basic functions of Xunhe Road, we will build a waterfront cycling and walking system, make full use of the existing urban waterfront space resources, optimize the landscape design along the line, and enhance the citizens’ experience of being close to water. During the "Fourteenth Five-Year Plan" period, the city built a waterfront slow-moving system of about 400 kilometers.

2. Continuously improve the quality of slow travel space and enhance the slow travel experience.

Implement refined design of intersections and promote slow and friendly transformation. Reasonable layout of the plane crossing, to minimize the pedestrian crossing distance. On the long section of crosswalk, set up safety islands according to local conditions to ensure the safety of pedestrians crossing the street; Bicycle and pedestrian crossing facilities shall be set as required to ensure the continuity and safety of riding and walking, and reduce the phenomenon of bicycle detour and retrograde. Carry out special investigation of special-shaped intersections, carry out intersection narrowing projects for large-scale intersections, and ensure the safety and comfort of bicycles and pedestrians crossing the street by adding safety islands, adjusting the cross-sectional structure of intersections, optimizing traffic streamline organization, and strengthening traffic order management. Create a bicycle priority demonstration intersection, and improve the riding efficiency and safety of the intersection by setting bicycle special signal lights and marking bicycle lanes.