Xinhua News Agency, Hefei, July 11th: Being tested on the crest of flood peak — — Scanning of Anhui’s fight against rare floods in history

Xinhua news agency reporter

Heavy rain! Heavy rain! 31 rivers exceed the warning water level; There are 1100 dangerous situations in river dikes; 106 weikou with an area of more than 1,000 mu were broken; More than 430 thousand people fought day and night in the front line of flood control; Emergency transfer and resettlement of more than 1 million people … …

At present, flood is the command! In this war of flood control and fighting against the flood, the affected areas in Anhui Province acted quickly. party member cadres at all levels, officers and men of the armed police and the people fought side by side to ensure the safety of people’s lives and property, and strive to minimize the disaster losses, composing a heroic song of "Fighting the Heaven and Fighting the Earth" in Jianghuai.

In times of crisis, they are the ark of life.

His back clung to the rushing torrent, such as the torrential rain, and he couldn’t open his eyes. Pan Dongxu climbed on his back, climbed his hands and feet on a steel rope, slid across a river where a bridge of six or seven meters collapsed, and arrived at Changyuan Village, which was besieged by the flood, and became the first rescue cadre to arrive.

"I was soaked through, my hair was stuck on my forehead, and I looked embarrassed." Wang Caijin, a villager from Changyuan Village, Wujiadian Town, Jinzhai County, recalled the appearance of Pan Dongxu, secretary of the county party committee, when he stopped at his house, which was fresh in his memory. The villager who was once a little biased against cadres said, "I didn’t expect a county party secretary to really put his life on the line to save the villagers." Pan Dongxu’s image of "being in a mess" has also attracted unanimous praise from public opinion. In two days, his video of zip line rescue has been clicked more than 400,000 times.

Anhui, which runs through the Yangtze River and Huaihe River, is suffering from the flood that is second only to that in 1954. All the lakes along the river are over-alert, and the inland rivers are generally flooded and dangerous. As of July 7, 106 weikou with an area of over 360,000 mu have been broken in the whole province, including 7 weikou with an area of over 10,000 mu.

"When the water rises, people are on the embankment", a striking red slogan stands on the Zhanghuwei in Wangjiang County. In the most critical "May 9 Wei" embankment, more than 300 officers and men of the Second Armed Police Hydropower Detachment and the Anqing Armed Police Detachment fought day and night here. They only rested for three or four hours every day, their feet were red and swollen, and their shoulders were worn out by sandbags, but they still stood on the embankment and stood in the flood. Due to extreme fatigue, some soldiers fell asleep after the rescue, wearing clothes full of mud and lying on the embankment.

Where there is danger, there are soldiers! Since the disaster occurred, the Anhui Military Region and the Provincial Armed Police Corps have successively dispatched more than 30,000 officers and men to block piping and protect dikes, and built a great steel wall between floods and the masses!

"In the face of the flood, our soldiers gave us courage, and party member cadres gave us backing." In the front line of emergency rescue and flood control in Anhui, such words have become the common aspiration of the masses.

Scientific flood control, life first.

There have been 31 rivers in Anhui that have exceeded the warning water level, of which 13 have exceeded the highest water level in history, and more than 1,000 dikes have been in danger … … Even if the turbid waves are monstrous and dangerous, there is nothing more precious between heaven and earth than people.

"I would rather listen to the masses and not listen to the masses crying." In the face of the rare flood with rainfall and inland water level "exceeding history", Xi Nanshan, secretary of Wuwei County Party Committee, asked party member cadres in the county to ensure the safety of their lives when transferring the affected people.

Xi Nanshan said that there has been no major flood in the Yangtze River basin for more than ten years, and many people have underestimated the disaster situation. There are many cases in which they do not want to leave during the relocation and resettlement. Finally, we demand that they must be forcibly taken away and the people in the dangerous areas should be carried out on their backs.

In order to ensure the safety of people’s lives to the greatest extent, Anhui Province adheres to the concept of respecting nature and combining blocking with dredging, and resolutely and decisively transfers people in high-risk areas such as low-standard dikes and reservoir flood discharge affected areas. Adhere to the principle of "storing and discharging at the same time", dispatch key pumping stations in advance to pump and discharge internal water and important reservoirs to receive floods at peak shifts, and timely dispatch flood storage areas to open floodgates to store floods and divert floods.

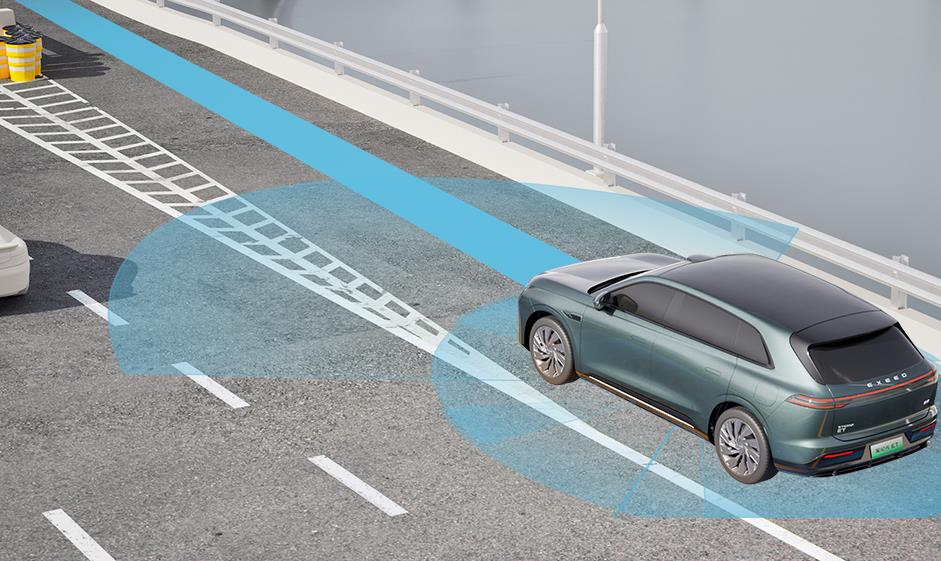

Various high-tech flood-fighting "artifacts" have also been quickly applied to flood control and disaster relief. In Wangjiang County, a domestic mobile folding water blocking wall has become a unique landscape for dam reinforcement. This water-blocking wall is several times faster than traditional sandbags, and it is not afraid of scouring, making it the first flood-fighting "artifact" in domestic disaster relief.

First-level response, card running and dike patrol, and coordinated military and civilian dispatch & HELIP; … In the face of rare floods, all walks of life go all out and unite as one!

Pan Hong, a community cadre who is still on duty for 12 hours every day on the dam after five months of pregnancy, said: "The rainstorm is urgent, and our hearts are even more urgent."

Seeing the flood approaching, all the cadres in sanhe town Zhongjie Community in Feixi were divided into two classes, and they took turns to be on duty on the dam 24 hours a day. More than 50 volunteers from the community volunteered to guard the dam together with grassroots cadres and army officers and soldiers.

Volunteers are active in the resettlement sites of the victims and in the flood-fighting levees. Many rivers in Taihu County, Anqing City have experienced super-historical floods. The swimming association of this county has formed a 34-member rescue team. In recent days, they have risked their lives to rescue in the rapid floods and become an important force in flood control and danger removal. All kinds of volunteers have played an important role in flood fighting and disaster relief. Some of them take care of the elderly at resettlement sites, some donate money and materials to the victims, some set up disaster relief teams to help villagers transfer their property, and some patrol the dangerous dams day and night … …

The big exam is still going on: sit tight and wait for it.

On July 11th, the latest weather forecast showed that the impact of Typhoon Nibert on Anhui was coming to an end, and the Yangtze River Basin in Anhui Province ushered in a short period of sunny and little rain. However, the water level of the Yangtze River is still rising; The tributary rivers and lakes are high; The resettlement population has exceeded one million … … The "alert" along the Yangtze River in Anhui Province has not been lifted.

Never slacken, be ready, and go all out. Anhui sent discipline inspection forces to go deep into the front line of flood control to supervise the war. More than 400,000 people in the province continue to fight and do their best to protect river banks, resettle victims, carry out health and epidemic prevention, and rebuild after the disaster.

At 700 centralized resettlement sites in the province, thousands of government workers and volunteers worked day and night to ensure that the affected people "have food, clothing, shelter, clean water and medical care" in strict accordance with the requirements of "five haves" put forward by Anhui Province.

In Huanglong Junior High School, a resettlement site in Huanglong Town, Huaining County, Anqing City, the reporter saw that among the more than 680 people transferred, some were enjoying the cool under the trees, some were taking a lunch break in their rooms, and some children were playing … … It’s calm and warm here under the catastrophe. Yao Jia, a villager, said: "The government is very considerate for us."

It is reported that the Yangtze River Basin in Anhui Province will encounter heavy rainfall in the future. In the face of possible basin floods and secondary disasters, Anhui Province has put forward efforts to make emergency preparations for flood control to ensure the safety of people’s lives and important dikes and facilities.

The flood has not receded, and the big exam will continue … …

(Reporter Wang Zhengzhong, Wang Shengzhi, Yang Yuhua, Jiang Gang, Yang Dingmiao, Chen Nuo, Bao Xiaojing)